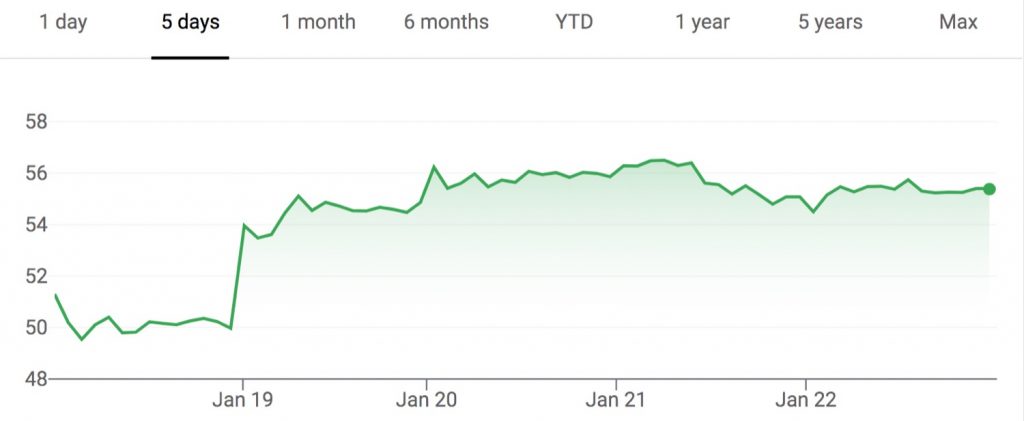

The value of GM stock rose during the January 19th, 2021 to January 22nd, 2021 timeframe. Shares closed the week at $55.40 per share, which represents an increase of $5.43 per share, or roughly 11 percent, compared to the previous week’s closing value of $49.97.

To note, markets were closed Monday, January 18th, in recognition of the Martin Luther King Jr. Day holiday.

Movement & Ranges

| Date | Open | Close/Last | High | Low |

|---|---|---|---|---|

| 1/22/2021 | $54.50 | $55.40 | $55.77 | $54.27 |

| 1/21/2021 | $56.33 | $55.08 | $56.97 | $54.76 |

| 1/20/2021 | $56.23 | $55.86 | $56.60 | $54.85 |

| 1/19/2021 | $53.69 | $54.84 | $55.14 | $52.26 |

By comparison, shares of GM’s cross-town rival, Ford Motor Company, increased $1.69 per share, or 17.2 percent, during the same timeframe.

GM Stock Factors

This week, GM stock value continued its impressive upward momentum after last week’s 16-percent increase, hitting a high of $56.97 on Thursday, a record for the “new GM,” before backtracking on Friday to close out at $55.40 per share.

Much of the upward momentum is attributed to the automaker’s latest all-electric vehicle efforts, debuts, and strategy, which includes an in-depth presentation released during the Consumer Electronics Show (CES) tech conference. Highlights from the presentation include the launch of BrightDrop, a new business venture aimed at providing last-mile electric delivery solutions, software, and services to delivery and logistics companies.

The first BrightDrop product to market will be the EP1, an electrically assisted pallet with a 200-pound capacity and adjustable speed up to 3 mph. Following the EP1 will be the EV600, an electrically powered light commercial van incorporating GM’s Ultium batteries and drive motors, offering a max range of 250 miles and a GVWR of just under 10,000 pounds.

GM also unveiled a series of futuristic concepts for the Cadillac luxury brand, including the Cadillac Personal Autonomous Vehicle, a self-driving luxury vehicle, and an autonomous, single-seater helicopter called the Cadillac Vertical Take-Off and Landing Vehicle (VTOL). GM also teased the new Cadillac Celestiq, an upcoming high-end flagship sedan utilizing an all-electric powertrain.

Earlier last week, GM unveiled its new safety brand, Periscope, which seeks to achieve the automaker’s stated goal of “zero crashes” via vehicle technology development, research, and advocacy. General Motors has also unveiled a new corporate logo that includes lowercase script and a square border with rounded edges. The modernized logo was designed to recognize the automaker’s renewed focus on electric vehicles, as well as its vision for zero crashes, zero emissions, and zero congestion.

The release of the new corporate logo coincides with a new marketing campaign titled “Everybody In,” which aims to promote GM’s upcoming line of EV models. Furthermore, GM stated that it is tapping “all the best startups” as part of its EV efforts.

Upward momentum may have been impacted by a global shortage of semi-conductor chips, which are required for a multitude of modern automotive electronic systems. The shortage has affected the entirety of the automotive industry, and could limit production going forward.

General Motors recently released its Q4 2020 and 2020 calendar year sales figures, with U.S. GM sales increasing 5 percent to 771,323 units. Sales increased at Chevrolet, Cadillac, and GMC, but decreased at Buick. The Q4 results cap a challenging, but impressive year for the automaker as it outperformed the industry average.

“GM outperformed the industry in the quarter and the full year by a significant margin because our manufacturing and supply chain teams and dealers helped keep people safe at work and our launches on track,” said GM executive vice president and president, GM North America, Steve Carlisle, in a press release. “Extraordinary teamwork has set up everyone to succeed in 2021 as the economy continues to recover and we further ramp up truck and SUV production.”

Critically, GM’s full-size pickup line, which includes the Chevy Silverado and GMC Sierra, collectively outsold the Ford F-Series in 2020, with a combined 847,110 units to the 787,422 units reported for the Ford F-Series. What’s more, the all-new Chevy Corvette C8 managed to outsell all rivals combined during Q4, with 21,626 units sold in the U.S. market throughout 2020.

The latest Q4 figures follow GM’s Q3 2020 earnings, which were headlined by $4 billion income on $35.5 billion in revenue. Compared to the third quarter of 2019, these results represent a 74 percent jump in income on equal revenue.

GM China sales also increased, rising 14 percent in Q4 of 2020, with 954,323 units. The Q4 figures mark the second increase for GM China in the 2020 calendar year, despite the challenges of the COVID-19 pandemic. Sales increased for Buick, Cadillac, and Wuling brands, but decreased for Chevrolet and Baojun.

GM’s luxury division, Cadillac, recently announced that the upcoming CT4-V Blackwing and CT5-V Blackwing ultra-high-performance sedans will debut February 1st. The new Blackwing sedans are hotly anticipated for their extreme levels of performance and refinement. Both models will offer enthusiast-oriented specs and equipment. As GM Authority was first to report, preorders for the sedans will open in conjunction with the debut next month, with GM confirming that a $1,000 deposit is required for the first 500 preorders (250 units per model).

New details recently leaked on a pair of upcoming all-electric crossovers which General Motors will build in a partnership with Japanese automaker Honda, including a possible production timeframe and production location. Honda recently announced that it would employ Cruise autonomous vehicles in Japan as part of its up-and-coming autonomous vehicle mobility service (MaaS) businesses.

Late in December, JP Morgan raised the GM stock price target from $53 to $57. Morgan Stanley Analyst Adam Jonas pointed to the automaker’s impressive connected services portfolio, as well as its proprietary semi-autonomous driver technology, Super Cruise.

“Just like Tesla monetizes autonomy though its full FSD (full self-driving) product, it seems GM is ready to increase monetization of its own autonomy solution called ‘Super Cruise,'” Jonas said.

On Wednesday, December 23rd, 2020, General Motors executive vice president and president, North America, Steve Carlisle, executed the sale of 10,217 shares of GM stock, according to a legal filing with the SEC. The shares were sold at an average price of $42.85 for a total value of $437,798.45. Carlisle still owns 65,626 shares in General Motors, valued at roughly $2.8 million. The sale follows a sell-off by GM CEO Mary Barra in November, at which time Barra sold nearly 175,000 shares of GM stock for a total valuation of nearly $7.7 million.

Late in November, General Motors signed a non-binding memorandum of understanding with Nikola stating that GM would only supply the start-up with hydrogen fuel cell technology, scaling back a previous agreement which stipulated GM’s involvement in development and production of the Nikola Badger electric pickup. Additionally, news of a Takata airbag recall affecting roughly 7 million GM vehicles worldwide likely impeded upward momentum in November.

In legal news, GM was on the receiving end of a class action lawsuit in December that claims the lithium-ion battery packs in the Chevy Bolt EV could pose a fire risk, as well as yet another class-action lawsuit over alleged oil consumption issues with the Gen-IV 5.3L Vortec V8 engine. The automaker is already facing other lawsuits regarding the oil consumption issue, two of which were filed in 2020. In December, a lawsuit filed against GM in California alleged the sale of defective infotainment systems.

In November, GM CEO Mary Barra shared the company’s plan to launch a total of 30 new electric vehicles globally by 2025, with a total investment of $7 billion. To put that in perspective, 40 percent of GM’s offerings will be fully electric by the end of 2025, compared to just three percent in 2021. The General also teased its future Chevy EV pickup truck during the Barclays 2020 Global Automotive Conference live stream event.

GM’s EV plans include the aforementioned BrightDrop EV600 commercial van and Chevrolet EV pickup truck, the GMC Hummer EV as well as the Cadillac Lyriq, the latter of which was revealed in August in near-production form and should have a starting price of under $60,000. Shortly before the reveal of the all-new GMC Hummer EV pickup truck on October 20th, GM stock prices rose 6.75 percent to $35.60 per share before continuing on to a weekly high of $38.03 on the morning of Friday, October 23rd.

In December, it was revealed that GMC now has 10,000 preorders for the new Hummer EV Edition 1 model.

GM stock gained upward momentum following the Hummer EV debut. Share values were also potentially propelled by news that the Wuling Hong Guang Mini EV is the best-selling electric vehicle in China for the months of October through December. The Mini EV sold 33,094 units during November, outselling the Tesla Model 3 and becoming the only EV in China to sell more than 30,000 units in a single month. The automaker has also confirmed its intention to sell next-generation full-size SUVs in China. Another factor worth noting is the expectation that GM shares would see a significant boost if the automaker were to spin-off its electric vehicle business. The recent sales record for Buick in China for the month of November may also be of interest to investors.

Another factor likely impacting GM stock performance is the election of Joe Biden as President of the United States, which has been accompanied by a shaky and unprecedented transition of power leading to uncertainty in the country and in the stock market, as evidenced by a riot at the U.S. Capitol. In response to the events in D.C., GM announced it was temporarily suspending all political contributions.

It was recently announced that the Biden Administration would ask agencies to revise fuel economy standards set under the Trump Administration.

Despite tight inventory, GM’s large pickup trucks sold well during Q3 of 2020, especially heavy-duty models – the Silverado HD and Sierra HD. Through the third quarter, GM’s large pickups gained 1.7 percentage points in retail market share, leading the segment with 37.5 percent share, based on J.D. Power data. It’s also worth highlighting the fact that the Chevy Corvette received a J.D. Power 2020 U.S. Resale Value Award; the study aims to identify which vehicle makes and models hold the highest percentage of their original resale value after three years of ownership.

Moreover, production of the C8 Corvette is on track following a stop in production due to supplier constraints, marking the third “restart” for the eighth-generation sports car’s assembly line this year. The 2021 Corvette C8 started production on December 11th.

In December, the General announced that it was investing further into Yoshi, an on-demand car maintenance startup company. General Motors Ventures also invested in Envisics, a U.K.-based startup developing augmented reality (AR) technology for automotive applications. GM believes the tech may find a place in the automaker’s upcoming all-electric vehicles, such as the Cadillac Lyriq.

In further tech news, Microsoft also invested in Cruise to help commercialize autonomous vehicle technology. GM also recently announced it was opening a dedicated 3D printing center in Warren, Michigan to explore the technology’s production potential. What’s more, GM announced that its robo-taxi division, Cruise, was now testing fully autonomous vehicles on the streets of San Francisco.

A new round of investments for the GM Factory Zero plant (previously known as Detroit-Hamtramck Assembly) was announced to address road repairs and other infrastructure needs. As of October, GM has resumed construction at the site of its Canada McLaughlin Advanced Technology Track in Oshawa after it was forced to put the project on hold due to the COVID-19 pandemic. Additionally, General Motors announced in November plans to invest between $1 billion and $1.3 billion in the GM Oshawa Assembly plant in order to begin producing the Chevy Silverado and GMC Sierra pickup trucks. In fact, construction work at the facility is already under way and the company is already recruiting for various leadership positions at the plant. News that GM would produce trucks at the Oshawa plant has sparked a sense of concern amongst U.S. workers, who are now anxiously anticipating volume reduction at U.S. plants. However, others expect that truck production at Oshawa will be used to expand supply of GM trucks, and that it won’t come at the expense of capacity at other GM truck plants.

Moreover, The General has announced that it’s seeking to add 1,100 new team members to its new Ultium Cells LLC battery production plant in Lordstown, Ohio. The facility will mass-produce Ultium battery cells for use in General Motors’ upcoming range of all-electric vehicles.

GM During COVID-19

The coronavirus pandemic initially forced GM to idle production across North America, South America and China. As a result, revenue fell sharply and GM began to rapidly burn through cash. However, GM has since resumed production in China. GM North American production resumed May 18th.

GM has taken major steps to get through the COVID-19 pandemic, fortifying its balance sheet by reducing and/or deferring expenses, while also shoring up cash and other forms of liquidity. GM has since repaid over half of the $16 billion borrowed to get through the pandemic.

The General also had to cope with a small number of coronavirus cases at some of its facilities, including 22 confirmed cases at the Arlington plant in Texas and more recently, about 25 confirmed cases at the Flint plant in Michigan. Despite a high rate of worker absenteeism, GM has decided to keep the third shift at the Wentzville Assembly plant by relocating employees, after previously announcing that it would be cut. However, no major outbreaks have been officially reported so far, and GM is keeping a close eye on its suppliers to make sure parts keep coming in. The automaker announced a vaccination distribution plan in December.

Additionally, refreshes for several GM vehicles have been delayed, including the Cadillac XT4, Chevrolet Traverse, Chevrolet Equinox, GMC Terrain, and Chevrolet Bolt EV. In fact, the overall launch cadence for several GM products has been pushed back, including the launch of the Cadillac CT4-V Blackwing and CT5-V Blackwing models, as well as the Corvette C8 Z06.

That said, there were still several good things happening for GM in 2020, including market share gains and production increases for the Silverado and the Sierra during Q2 2020, as well as strong Chevrolet Blazer sales and Chevrolet Trailblazer sales. Notably, GMC Sierra inventory is extremely low as the automaker can’t build enough units to meet strong demand. The majority of GM’s redesigned full-size SUVs are now in stock on dealer lots, including the 2021 Chevrolet Tahoe and 2021 Suburban, as well as the 2021 GMC Yukon and 2021 Yukon XL. Notably, the diesel-powered Tahoe and Suburban are now available to order; the same is true for the GMC Yukon diesel.

GM Before COVID-19

It’s worth noting that GM stock value has gone up and since mid-2018, long before coronavirus complications, though shares never dipped to the levels observed in the first quarter of 2020.

For the most part, GM stock was in limbo throughout 2019, seeing a jump in value as a result of overwhelmingly positive Q2 2019 earnings, wherein the automaker outperformed expectations. Prior to the COVID-19 pandemic, several factors negatively impacted GM stock value during 2019, including:

- A UAW labor strike that lasted 40 days, resulting in no vehicles built in the United States during that timeframe. Production was also idled in other countries as a result of supply chain-related issues caused by the UAW strike

- Warning signs of an economic slowdown

- Escalations with a trade war with China

Over the last few years, GM has taken several steps to increase its stock value, including exiting markets where it is unable to turn a profit (such as Europe, South Africa and India), closing plants in various locations around the world, divesting loss-making divisions (such as Opel-Vauxhall), adjusting its business model to prioritize profitability over chasing market-share goals, refocusing the Cadillac luxury brand to increase its share of high-profit automobiles, investing heavily in new-age mobility ventures like electric vehicles and autonomous driving tech, discontinuing unprofitable sedan models (Cruze, Sonic, Volt, Impala, Regal, LaCrosse, XTS, CT6) and closing various plants to focus on more profitable crossovers, SUVs and pickup trucks.

To further minimize activities in unprofitable markets, General Motors also announced its intention to phase out the Holden brand in Australia and New Zealand, in addition to pulling the Chevrolet brand out of Thailand while selling the GM Rayong Manufacturing Complex to Great Wall Motors. GM also announced it would end its Maven car-sharing service program.

Despite these actions, the value of GM stock has historically struggled to surpass the $40 mark, spending most of its time in the $33-$38 range (prior to the COVID-19 pandemic). This is somewhat problematic given the “new GM” Initial Public Offering (IPO) of $33 per share in November 2010, resulting in frustration among investors.

We’ll continue to stay on top of all the latest developments related to GM stock, so be sure to subscribe to GM Authority for ongoing GM stock news and complete GM news coverage.

Comments

not sustainable if fuel prices rise wall street does not look 7 yrs out which may be longer if low mpg models sales fall which is financing electrification

Wall Street is throwing a ton of money away at companies assuming EVs will be a success. If they’re not, then that’s how you create a depression.

Like em or not EV products are coming and will continue to be a growing part of the automotive market.

GM is seeing reward here as they have equally invested in profitable ICE and EV products. No matter what the public chooses GM will have a profitable vehicle to fit their needs and coming government regulations.

Depressions are created by governments running up great deficits and try to fix them with high taxation and no corresponding growth of the economy.

So if anyone has doom and gloom it should be directed to areas that are far beyond GM offering more than a mix of ICE and EV products.

GM is going to offer equal products of ICE and EV and let the public migrate at their own pace. There is no better way to do this and many companies could not afford it.

“Depressions are created by governments running up great deficits and try to fix them with high taxation and no corresponding growth of the economy.”

i don’t think that is what caused the great depression 1929.

The government’s “easy money” policies caused an artificial economic boom and a subsequent crash.

President Herbert Hoover’s interventionist policies after the crash suppressed the self-adjusting aspect of the market, thus preventing recovery and prolonging the recession.

After Hoover left office, Franklin Delano Roosevelt’s “New Deal” expanded Hoover’s interventionism into nearly every aspect of the American economy, thus deepening the Depression and extending it ever longer.

Labor laws such as the Wagner Act struck the final blow to the remaining healthy sectors of the economy, dragging the last remaining bulwarks of productivity to their knees.

Steve they lowered interest rates and lowered the value of the dollar s its over printing. This created inflation that stopped buying and liked the market and jobs.

My point is raising the price of gas is not going to kill everything. Generally people buy less gas supplies rise and the price falls again.

There is still a lot more to this but this is enough to make the point. Side effects are more government debts trying to get the economy going and more taxes to pay for it add to the misery..

Here is the tax part from 1932.

Tax exemptions were lowered.

“Earned income credit” was eliminated.

Normal tax rates were raised from a range of 1.5% to 5% to a range of 4% to 8%.

Surtax rates were raised from 20% to a maximum of 55%.

Corporation tax rates were boosted from 12% to 13.75 and 14.5%.

Estate taxes were raised.

Gift taxes were imposed with rates from .75 to 33.5%.

On top of all these, a 10% gasoline tax was imposed, a 3% automobile tax, a telegraph and telephone tax, a 2¢ check tax, and many other excise taxes. And, finally, postal rates were increased substantially.

there is a difference between monetary and fiscal policies. here is my understanding of the great depression.

the roaring twenties created asset bubbles. when everything crashed in 1929, the economy froze. everyone was scared to death so few were spending. hoover didn’t want to stimulate the economy with increased spending so economic paralysis lingered and prolonged the depression.

so when fdr came in, he stimulated the economy by putting people to work. that was a lifeline until the ultimate economic stimulus came in the form of world war two.

the lesson of the great depression is when the economy is in a deep recession/depression, government has to step in to stimulate the economy when no one else will.

Funny how you argue what was copied from a economics history book.

By comment was a general comment not on on the Great Depression. Not I said Depressions.

If you are just looking for a useless argument find someone else brother. You are disputing things I did not say and quotes from documented history. Checkmate!

i didn’t have to copy anything. my godparents lived through the depression they told me all about it. if you don’t want to defend your position. that’s cool.

LOL! Thank god you did not stay at a Holiday Inn……

I hate to tell you everyone in the room here had family that went through the big one unless you were beamed in.

Based on your Criteria I must have a PHD on this this topic as my father went though the big one as a kid. Hunted and planted to not starve.

Nothing to defend here. Checkmate!

for someone who as “checkmate”d me not once but twice, you sure don’t act like it.