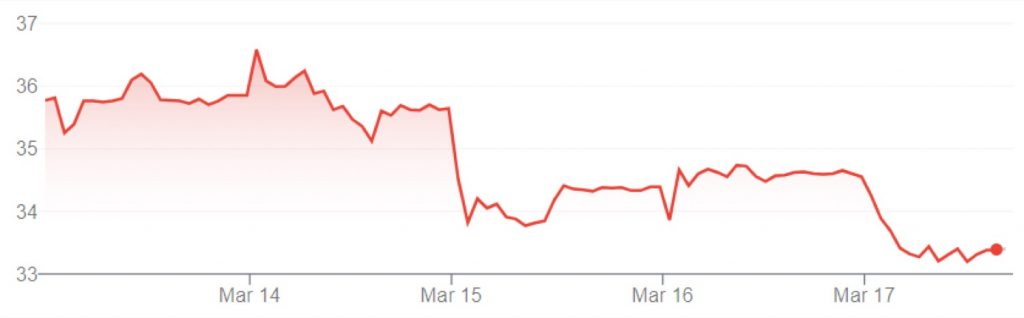

The value of GM stock decreased during the week of March 13th to March 17th, 2023, compared to the stock’s closing value the week prior. Shares closed the week at $33.38 per share, representing a decrease of $3.14 per share, or 8.6 percent compared to the previous week’s closing value of $36.52.

Movement And Range

| Date | Open | Close/Last | High | Low | |

|---|---|---|---|---|---|

| 3/17/2023 | $34.28 | $33.38 | $34.28 | $33.12 | |

| 3/16/2023 | $33.85 | $34.61 | $34.92 | $33.76 | |

| 3/15/2023 | $34.61 | $34.33 | $34.62 | $33.63 | |

| 3/14/2023 | $36.46 | $35.60 | $36.67 | $35.08 | |

| 3/13/2023 | $35.62 | $35.76 | $36.31 | $34.86 |

By comparison, shares of GM’s crosstown rival, Ford Motor Company, decreased 6.61 percent, or $0.80 per share, during the same timeframe.

GM Stock Factors

GM stock value fell again this week after an even-larger decrease last week.

Some of the factors affecting GM stock value this week include the announcement of Purolator as a new GM BrightDrop customer, while in production news, Corvette production and GM truck production at the GM Silao plant in Mexico will both be halted next week. GM has also announced a 10-percent increase in pay for workers at the Silao plant. Finally, a recent report indicates that GM CEO Mary Barra has met with U.S. Senators to discuss autonomous vehicle legislation.

GM Stock Value Macro Factors – Strategy

General Motors continues to drive towards the mass adoption of all-electric vehicles, laying out its ambitious global future growth strategy last the summer and reaffirming its commitment to deploying zero-emission and autonomous technologies around the world. GM also previously announced several major investments, including a massive $7 billion for its Michigan-based production facilities that includes $4 billion to convert the Orion Township plant for production of the new Chevy Silverado EV and Sierra EV, $2.5 billion for a third Ultium Cells battery plant, and a further $500 million to support production of the next-generation Chevy Traverse and Buick Enclave. The $7 billion investment is the largest single investment in GM history, and prompted responses from the White House, among other groups. GM is now shooting for EV production capacity greater than 1 million units, although the automaker does not expect EV production to ramp up until later in the year.

GM also announced a new round of investments totaling $918 million benefitting four GM’s U.S.-based production facilities, including $579 million for the GM Flint Engine plant in Michigan, $216 million for the GM Bay City GPS plant in Michigan, $68 million for the GM Rochester plant in New York, and $55 million for the GM Defiance plant in Ohio. The investments will support production of GM’s next-gen Small Block V8 gasoline engine, as well as EV production.

Architectural rendering of the completed first phase of GM’s Wallace Battery Cell Innovation Center. The Wallace Center will will accelerate new technologies like lithium-metal, silicon and solid-state batteries along with production methods that can quickly be deployed at battery cell manufacturing plants like GM’s joint ventures with LG Energy Solution in Lordstown, Ohio, and Spring Hill, Tennessee, along with other undisclosed locations.

In December, U.S. Department of Energy finalized a $2.5B loan for Ultium Cells LLC to facilitate the construction of new battery manufacturing plants. In addition, the State of Michigan approved the construction of Lear Corporation’s new production facility to supply GM with battery disconnect units set for use in future GM EVs.

The automaker has stated that it is now holding 170,000 reservations for the new Chevy Silverado EV. GM is currently no longer taking reservations for the GMC Hummer EV, topping out at 90,000, nor is the automaker taking reservations for the 2024 Chevy Blazer EV following the fulfillment of its reservation target.

Back in November of 2021, the automaker hosted the grand opening of its new GM Factory Zero production facility in Michigan, GM’s first dedicated all-electric vehicle assembly plant. The first product to roll off the line was the 2022 GMC Hummer EV Pickup. GM CEO Mary Barra rang the NYSE opening bell from the factory floor the morning of the plant’s opening, and President Biden visited for a tour, driving the new Hummer. GM stock value rose to $65 per share following the opening.

During the most recent GM Investor Day event, the automaker also said its EV business would be “solidly profitable” in 2025, that BrightDrop would reach $1B in revenue in 2023, and that its digital retailing platform for EV sales would save the company $2,000 per vehicle. It also expects to double its revenue by 2030 through new software platforms and connectivity, while adding 50 new in-vehicle digital services by 2026, creating a wealth of new potential revenue streams. GM will also generate revenue by rolling out new software such as the Future Roads data platform and enhanced subscription services, while expanding OnStar Insurance service to all 50 states.

To help ramp up EV production, agreements were announced regarding electric and hydrogen energy sources, as GM will collaborate with Nel ASA on affordable hydrogen production while a long-term deal was inked with Vale for supplying the nickel needed for manufacturing battery packs. GM previously announced a joint venture with POSCO Chemical to process materials for the automaker’s Ultium batteries, plus a joint investment with Lithium Americas for raw battery materials.

Back in 2020, GM CEO Mary Barra shared the company’s plan to launch a total of 30 new electric vehicles globally by 2025, with a total investment of $7 billion. To put that in perspective, 40 percent of GM’s offerings will be fully electric by the end of 2025, compared to just three percent in 2021. GM CEO Mary Barra has also stated that General Motors could catch up to Tesla in EV sales by 2025, while announcing plans to build a new network of charging stations across the U.S. What’s more, GM has made a commitment to phase out fossil fuel vehicles by 2040, and, per the GM 2021 Sustainability Report, the automaker states that it used more than 17 million pounds of recycled plastic in the manufacturing of its vehicles in 2021.

With regard to EV and AV investments, GM has earmarked a total of $35 billion between now and 2025. GM’s Cruise autonomous vehicle brand is expected to rake in $50 billion over the coming years, with the finalization of autonomous vehicle rules from the NHTSA paving the way for GM to launch a fleet of new self-driving ride-share vehicles. Cruise division is now seeking to test the fully autonomous Cruise Origin without a steering wheel or pedals on the streets of San Francisco. SoftBank previously announced a further $1.35 billion investment in GM’s Cruise AV arm. The Cruise AV division reported a $500 million loss for Q2 of 2022. The NHTSA recently opened a safety probe regarding GM’s Cruise AVs after reports that some driverless cars exhibited erratic behaviors that caused blocked traffic and minor fender-benders. Cruise reports that it is currently operating roughly 300 AVs on city streets.

With regard to its private passenger vehicle semi-autonomous products, GM doubled the size of its current Super Cruise road network, and the company’s full-size SUVs including the Chevy Tahoe and the Chevy Suburban were the first models built with the updated Super Cruise software. Units equipped with driver assist system already on the road will receive an over-the-air update.

To promote the pivot towards EVs, Buick has introduced a new logo and brand identity as it transitions to an all-electric portfolio by 2030. Buick has also revealed the new Buick Wildcat EV Concept vehicle as a preview for its upcoming EV design language.

Although investors are eager to see GM pivot to EVs, some groups are frustrated by the automaker’s progress. Investment banking company Morgan Stanley dropped its price target from $75 to $55 in February 2022, sending GM stock tumbling. A Citigroup analyst also lowered his GM stock price target to $87 per share in June 2022, while German multinational investment bank Deutsche Bank downgraded its stock rating from Buy to Hold in July 2022. That said, some investors are coming around, with GM CEO Paul Jacobson purchasing 35,000 shares of GM stock in April 2022, much more than was required by his executive position, and Cathie Wood’s Arc Invest Firm also purchasing shares after Wood criticized GM’s move towards EVs. GM President Mark Reuss has also stated that GM has learned from past mistakes with regard to bringing electric vehicles to market.

GM previously issued $2.5 billion in new senior unsecured notes, and recently announced a first quarter 2023 dividend of 9 cents per share on the company’s outstanding shares of common stock.

Finally, GM previously announced a series of job cuts in the United States and abroad. Roughly 500 employees were reportedly let go in the company’s latest cost reduction effort. Additionally, GM has announced a new voluntary employee separation program in an effort to reduce costs.

GM Stock Value Macro Factors – Sales

GM’s Q4 2022 sales figures were marked by a 41-percent year-over-year increase in the U.S. to 623,261 units. Sales increased at Chevrolet, Cadillac, and GMC brands, but decreased at Buick. The new figures brought GM’s total U.S. annual sales to 2.27 million units, besting Toyota’s 2.1 million units sold to once again make GM the number-one automaker in the U.S.

GM’s Q3 2022 sales figures were released in early October, which were highlighted by a sales increase of 24 percent to 555,580 units, with all four of GM’s U.S. brands seeing a sales increase.

GM sales figures for Q2 of 2022 decreased by 15 percent to 582,269 units, with sales falling at all four U.S. GM brands. However, GM Executive Vice President and President, North America, Steve Carlisle, indicated in a statement that the company’s “long-term momentum will continue to build thanks to the launches of groundbreaking new EVs like the GMC Hummer EV and Cadillac Lyriq, and the tremendous customer response to the Chevrolet Silverado and GMC Sierra.” Also during the second quarter, GM’s new CarBravo used vehicle shopping service opened for business.

GM sales figures for Q1 of 2022 fell 20 percent to 512,846 units, with all four U.S. brands seeing a dip. GM expected continuing disruptions to the global supply chain will affect inventory going forward, as seen in the automaker’s Q2 2022 results, but offered tempered optimism that 2022 will outperform 2021 in terms of production, especially towards the latter half of the year. GM China sales figures were down 21 percent in Q1 of 2022 to 613,400.

GM Q2 2022 Global Deliveries

* Vehicle deliveries in thousands| Q2 2022 / Q2 2021 | Q2 2022 | Q2 2021 | YTD 2022 / YTD 2021 | YTD 2022 | YTD 2021 | |

|---|---|---|---|---|---|---|

| Global Deliveries | -19% | 1,421 | 1,757 | -19% | 2,848 | 3,502 |

| North America | +14% | 687 | 601 | -16% | 1,288 | 1,540 |

| - U.S.A | +13% | 582 | 513 | -18% | 1,095 | 1,330 |

| Asia/Pacific, Middle East and Africa | -15% | 627 | 736 | -22% | 1,362 | 1,755 |

| - China | -21% | 484 | 613 | -28% | 1,097 | 1,531 |

| South America | +19% | 107 | 90 | -4% | 197 | 205 |

| - Brazil | +32% | 66 | 50 | -7% | 116 | 125 |

GM Q2 2022 Earnings Summary

| Q2 2022 | Q2 2021 | Q2 2022 - Q2 2021 | % CHANGE Q2 2022 / Q2 2021 | |

|---|---|---|---|---|

| GAAP METRICS | ||||

| NET REVENUE | $35,759 | $34,167 | $+1,592.0 | +4.7% |

| NET INCOME ATTRIBUTED TO STOCKHOLDERS | $1,692 | $2,836 | $-1,144.0 | -40.3% |

| NET INCOME MARGIN | 4.7% | 8.3% | -3.6% | N/A |

| EARNINGS PER SHARE (EPS) DILUTED | $1.14 | $1.90 | $-0.76 | -40% |

| NON GAAP METRICS | ||||

| EBIT-ADJUSTED | $2,343 | $4,117 | $-1,774.0 | -43.1% |

| EBIT-ADJUSTED MARGIN | 6.6% | 12.0% | -5.4% | N/A |

| ADJUSTED AUTOMOTIVE FREE CASH FLOW | $1,407 | $2,478 | -$1,071 | -43.2% |

| EPS DILUTED - ADJUSTED1 | $1.14 | $1.97 | $-0.8 | -42.1% |

| DIVISIONAL RESULTS | ||||

| GM NORTH AMERICA EBIT-ADJUSTED | $2,299 | $2,894 | $-595.0 | -20.6% |

| - GM NORTH AMERICA EBIT-ADJUSTED MARGIN | 8.0% | 10.4% | -2.4% | N/A |

| GM INTERNATIONAL EBIT-ADJUSTED | $209 | $15 | $+194.0 | - |

| GM CHINA EQUITY INCOME | -$87 | $276 | $-363.0 | -131.5% |

| CRUISE EBIT-ADJUSTED | -$543 | -$332 | $-211.0 | -63.6% |

| GM FINANCIAL EBT-ADJUSTED | $1,106 | $1,581 | $-475.0 | -30% |

GM Stock Value Macro Factors – Earnings

The release of GM’s Q4 2022 earnings were headlined by $2.0 billion in net income on $43.1 billion in revenue. Compared to the fourth quarter of 2021, these results are a 17.6-percent improvement in net income and 28-percent increase in revenue. GM cited “wholesale volume growth and robust pricing across the portfolio,” which was partially offset by “mix normalization, commodity costs, and GMF [GM Financial] EBT lower” than last year.

GM’s Q3 2022 financial results were highlighted by a record $41.9 billion in revenue and EBIT-adjusted of $4.3 billion, with GM reaffirming its full-year earnings guidance. Analysts, however, are expecting a significant decline in profits next year in the wake of a projected weakening in consumer demand.

GM’s Q2 2022 earnings results were highlighted by $1.7 billion in income on $35.8 billion in revenue. Compared to the second quarter of 2021, these results represent a 40-percent downturn in income and 4.7-percent upturn in revenue. GM cited “higher corporate expenses primarily due to year-over-year market-to-market changes,” forecasting full-year net income of $9.6 billion to $11.2 billion, and EBIT-adjusted between $13.0 billion and $15.0 billion.

Previously, GM’s Q1 2022 earnings report was headlined by $2.2 billion in income on $36 billion in revenue, a 33.3-percent drop in income and 10.8-percent growth in revenue compared to the first quarter of 2021. The automaker cited strong product demand as an influencing factor, in addition to good results from GM’s captive finance arm, GM Financial. GM reaffirmed its forecast of $9.4 billion to $10.8 billion in net income and EBIT-adjusted between $13 billion and $15 billion.

GM Q4 2021 Earnings Summary

| Q4 2021 | Q4 2020 | Q4 2021 - Q4 2020 | % CHANGE Q4 2021 / Q4 2020 | |

|---|---|---|---|---|

| GM FINANCIAL EBT-ADJUSTED | $1,180 | $1,039 | $+141.0 | +13.6% |

| GAAP METRICS | ||||

| REVENUE | $33,584 | $37,518 | $-3,934.0 | -10.5% |

| NET INCOME | $1,741 | $2,846 | $-1,105.0 | -38.8% |

| EARNINGS PER SHARE (EPS) DILUTED | $1.16 | $1.93 | $-0.77 | -39.9% |

| NON GAAP METRICS | ||||

| EBIT-ADJUSTED | $2,839 | $3,712 | $-873.0 | -23.5% |

| EBIT-ADJUSTED MARGIN | 8.5% | 9.9% | -1.4% | 11.3% |

| AUTOMOTIVE OPERATING CASH FLOW | $9,384 | $5,243 | $4,141 | +79% |

| ADJUSTED AUTOMOTIVE FREE CASH FLOW | $6,403 | $3,433 | $2,970 | +86.5% |

| EPS DILUTED - ADJUSTED1 | $1.35 | $1.93 | $-0.6 | -30.1% |

| DIVISIONAL RESULTS | ||||

| GM NORTH AMERICA EBIT-ADJUSTED | $2,165 | $2,612 | $-447.0 | -17.1% |

| - GM NORTH AMERICA EBIT-ADJUSTED MARGIN | 8.1% | 8.7% | -0.6% | N/A |

| GM INTERNATIONAL EBIT-ADJUSTED | $275 | $283 | $-8.0 | -2.8% |

| - CHINA EQUITY INCOME | $244 | $248 | $-4.0 | -1.6% |

- Figures in millions of USD, except for per share amounts and percentages.

GM Stock Value Macro Factors – Products

GM is now pivoting to all-electric power, recently debuting several important EV models, including the 2024 Chevy Equinox EV, the 2024 GMC Sierra EV Denali Edition 1, the 2024 Chevy Blazer EV, and the Cadillac Celestiq. However, the automaker still has a wealth of ICE-powered vehicles on offer, recently unveiling the all-new 2023 Chevy Colorado, the 2023 Chevy Tahoe RST Performance Edition, the refreshed 2024 Chevy Silverado HD, the 2024 Chevy Trax crossover, the 2024 GMC Sierra HD, and the all-new 2023 GMC Canyon. GM has also unveiled the new 2024 Corvette E-Ray, the first-ever hybrid-electric Corvette model. Production of the new GMC Hummer EV SUV is now underway.

GM stock value was on the rise early in January 2022 with the introduction of several new GM EVs in conjunction with the 2022 Consumer Electronics Show, highlighted by the 2024 Chevy Silverado EV. GM stock value rose to a record high of $67.21 per share following a keynote speech delivered by GM CEO Mary Barra. Following the event, Barra indicated that reservations for the Silverado EV RST First Edition were filled in just 12 minutes. Other announcements at CES 2022 included the Chevy Equinox EV and Cadillac InnerSpace AV concept. Further critical debuts early in 2022 included the new 2023 Cadillac Escalade-V.

GM is now offering the BrightDrop Zevo 600 all-electric light commercial vehicle, formerly known as the BrightDrop EV600. The new van is the fastest-developed vehicle in GM history. The Zevo 600 will be joined by the smaller BrightDrop Zevo 400. Merchant Fleet recently placed an order for 5,400 units of the new Zevo 400, previously known as the BrightDrop EV410. Full-scale production of the BrightDrop vans is underway now at the GM CAMI plant in Canada. BrightDrop has also announced that it has expanded its business to Canada.

The start of production for the new Cadillac Lyriq EV was celebrated at the GM Spring Hill plant in Tennessee in March 2022, coinciding with the announcement that the facility will also accommodate the production of additional EV models. Cadillac Lyriq deliveries are ramping up now. What’s more, GM announced the new Ultra Cruise autonomous driving system, which promises true “door-to-door hands-free driving” capabilities in 95 percent of all driving scenarios, with plans to eventually make the system available on every paved road in the U.S. and Canada.

GM Stock Value Macro Factors – Events

The global microchip shortage has also affected GM stock value by impacting production, vehicle supply, and pricing, with production pauses for the Chevy Bolt EV and Bolt EUV, as well as a production pause for the Chevy Camaro, Cadillac CT4, and Cadillac CT5. However, it also looks like GM is turning a corner on production issues, recently clearing out 20,000 unfinished vehicles and addressing missing features for the GMC Acadia and Chevy Colorado. GM has also announced that it has cleared out three-quarters of its vehicle backlog, while GlobalFoundries and GM have signed a longterm agreement to supply GM with new microchips.

General Motors is also currently gearing up to make significant changes to its supply chain in the hopes of avoiding future shortages. That includes the development of new microcontrollers, with GM CEO Mary Barra stating GM is expected to launch its own line of chips by 2025. In January of the 2022 calendar year, the Biden Administration pushed Congress to pass a $52 billion microchip production bill aimed at alleviating the ongoing shortage.

GM Stock Value Micro Factors

The General previously announced that LG Electronics Inc. has agreed to cover $1.9 billion of the $2 billion in costs associated with the replacement of the recalled Chevy Bolt EV and Chevy Bolt EUV battery packs. General Motors has also announced a new battery software update for the recalled Chevy Bolt EV and EUV. However, a lawsuit against the automaker was filed regarding the recall.

GM has also announced that it will replace the battery modules on roughly 50,000 units of the 2017 though 2019 Chevy Bolt EV affected by a potential fire risk. The automaker later decided to extend the battery replacement on all model years of the Bolt EV, in addition to the all-new Bolt EUV. Despite the fault laying with battery producer LG Energy Solution, GM CEO Mary Barra announced that GM will continue its relationship with LG going forward.

The National Highway Traffic Administration (NHTSA) recently closed its investigation into the recent Chevy Bolt and Bolt EUV fires, while Chevy Bolt production has since restarted.

In other legal news, certain examples of the 2022 Chevy Colorado and 2022 GMC Canyon mid-size pickups were recalled for an issue related to improperly welded seat frames, while no recall will be issued for alleged Chevy Equinox and GMC Terrain steering issues following the conclusion of an investigation by the NHTSA. A report from the NHTSA indicates that GM recalls accounted for only 8 percent of all vehicle recalls in 2022.

Previously, GM was hit with a $102 million verdict in a lawsuit concerning its 5.3L V8 engine. Additionally, a Chevy Bolt EV class action battery lawsuit was allowed to continue. Finally, more than 95,000 GM vehicles were recently recalled for faulty rearview cameras.

In political news, President Biden has signed the CHIPS And Science Act into law, providing funding for domestic chips manufacturing and new technology development. Investments also include $5 billion for the nationwide EV charging network with sweeping EV charging infrastructure approval from the Biden Administration. What’s more, several GM EVs will be eligible for tax credits under the Inflation Reduction Act, although a recent report indicates GM won’t be eligible for the full EV tax credit. In further political news, California can once again set its own emissions guidelines, while the Biden administration is urging automakers to ensure that their vehicle lineups consist of at least 40 percent EVs by 2030. California has also finalized plans to ban the sale of new ICE-powered vehicles by 2035. Meanwhile, Biden has signed an executive order calling for an end to the purchase of fossil fuel fleet vehicles by 2035.

The greater auto industry, including the UAW workers union and major manufacturers like General Motors, have called on President Biden to roll out tax credits and incentives to drive EV sales. The latest is that the Biden Administration plans to roll out a $100 billion plan for new EV rebates. It was recently announced that the Ultium battery plant in Ohio will move forward on labor negotiations with the UAW.

GM stock value fell late last year following the announcement that Dan Ammann was stepping down as CEO of the GM-backed autonomous vehicle startup Cruise. Ammann’s departure was the second high-profile executive shakeup in a week, following the departure of GM innovation head Pam Fletcher. More recently, GM appointed Ashish Kohli as the new VP of Investor Relations. In October, Arden Hoffman was named as GM’s new senior vice president and chief people officer, while ex-Tesla executive Jonathan McNeill has joined the GM Board of Directors.

GM stock value increased considerably over the course of 2021, only to later rescind some of those gains and fall below the $50-per-share mark. GM stock value was back on the rise later in the year, however, hovering around the $55- to $60-per-share mark in December before breaking into record highs in January and peaking at $67.21 following CES 2022. In February, GM stock value fell back around the $50-per-share mark, dipping below the mark later in the month to open at $46 per share in March. GM stock value was on a downward trend through the summer, falling under the $40-per-share mark to open just over $30 per share in July and August, while rising towards the $40-per-share mark in September. GM stock value opened at $32.46 in October and just under $40-per-share in November at $39.35, rising to just over $40.00 per share in December.

Now in 2023, GM stock value opened around $34 per share in January, rising to $39.45 per share in February. Now in March, GM stock value is in a steady decline towards the $30-per-share mark.

| Month | Opening Value |

|---|---|

| January 3rd | $34.02 |

| February 1st | $39.45 |

| March 1st | $38.68 |

We’ll continue to stay on top of all the latest developments related to GM stock, so be sure to subscribe to GM Authority for ongoing GM stock news and complete GM news coverage.