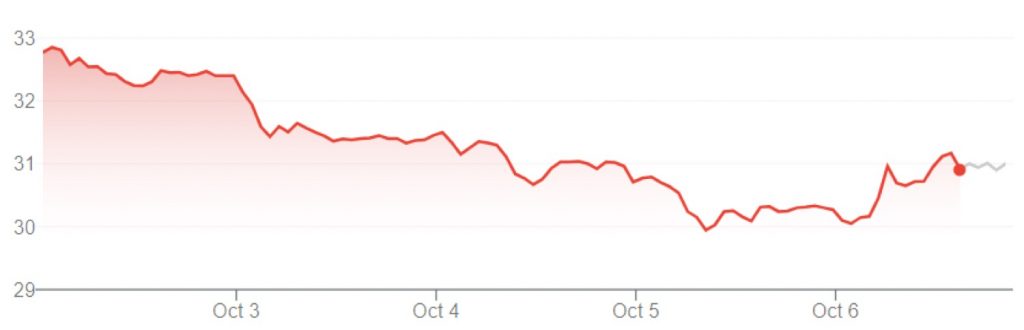

The value of GM stock decreased during the week of October 2nd to October 6th, 2023. Shares closed the week at $30.90 per share, representing a decrease of $2.07 per share, or 6.28 percent compared to the previous week’s closing value of $32.97 per share.

| Date | Open | Close/Last | High | Low | |

|---|---|---|---|---|---|

| 10/6/2023 | $30.10 | $30.90 | $31.36 | $29.87 | |

| 10/5/2023 | $30.78 | $30.31 | $31.14 | $29.72 | |

| 10/4/2023 | $31.35 | $31.04 | $31.50 | $30.63 | |

| 10/3/2023 | $32.05 | $31.38 | $32.19 | $31.31 | |

| 10/2/2023 | $32.84 | $32.47 | $33.06 | $32.16 |

By comparison, shares of GM’s crosstown rival, Ford Motor Company, decreased 3.38 percent, or $0.42 per share, during the same timeframe.

GM Stock Factors

GM stock value plummeted this week after increasing slightly last week and falling 4 percent the week prior.

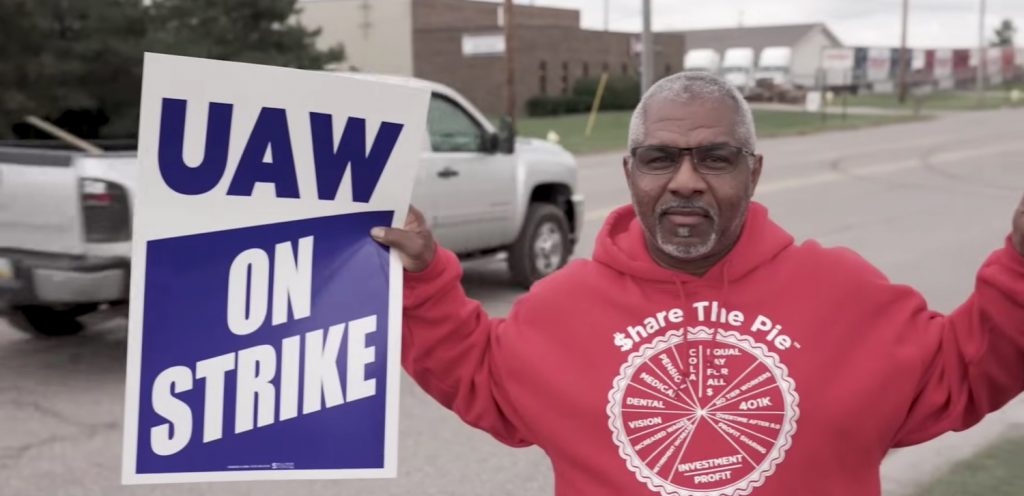

The biggest factor affecting GM stock value this week continues to be the UAW labor strike. The big headline is that GM has agreed to include workers at its Ultium Cells battery plants under the national UAW agreement, a move that the UAW says spared it from expanding the strike to include the GM Arlington plant in Texas. However, the strike continues to have negative repercussions across GM’s supply chain, resulting furloughs in Lockport, New York; Toledo Propulsion Systems in Ohio; and GM’s Ohio Metal Center and Marion Metal Center. The strike is also resulting in job losses for auto suppliers.

It’s estimated that GM is losing $21 million a day due to the strike, and recently secured a $6 billion line of credit to absorb some of the losses. GM recently announced it had submitted a sixth offer in negotiations. GM will also continue to cover medical benefits for striking workers, even though it is not contractually obligated to do so. Meanwhile, the UAW has dropped its unfair labor practice charge against GM and Stellantis.

In further news, GM may be facing a massive recall of more than 20 million vehicles due to faulty airbag inflators.

GM stock value dropped below $30 per share this week for the first time in three years.

GM Stock Value Macro Factors – Strategy

General Motors continues to drive towards the mass adoption of all-electric vehicles, laying out its ambitious global future growth strategy last summer and reaffirming its commitment to deploying zero-emission and autonomous technologies around the world. GM also previously announced several major investments, including a massive $7 billion for its Michigan-based production facilities that includes $4 billion to convert the Orion Township plant for production of the new Chevy Silverado EV and Sierra EV, $2.5 billion for a third Ultium Cells battery plant, and a further $500 million to support production of the next-generation Chevy Traverse and Buick Enclave. The $7 billion investment is the largest single investment in GM history, and prompted responses from the White House, among other groups. GM is now shooting for EV production capacity greater than 1 million units, although the automaker does not expect EV production to ramp up until later in the year. The governor of Indiana recently confirmed the location of GM’s fourth major battery plant.

GM has also announced a new round of investments totaling $918 million benefitting four GM’s U.S.-based production facilities, including $579 million for the GM Flint Engine plant in Michigan, $216 million for the GM Bay City GPS plant in Michigan, $68 million for the GM Rochester plant in New York, and $55 million for the GM Defiance plant in Ohio. The investments will support production of GM’s next-gen Small Block V8 gasoline engine, as well as EV production. More recently, GM announced a $1 billion investment for two Flint-area GM production facilities and a C$280 investment for the GM Oshawa plant in Canada, all of which will support next-gen HD truck production, plus a $500 million investment for the GM Arlington plant to support-next-gen SUV production, $632 million for the GM Fort Wayne plant to support next-gen ICE-based pickup production, as well as $920 million for the DMAX plant in Brookville to support next-gen ICE-based HD truck production.

GM says it is holding 170,000 reservations for the new Chevy Silverado EV. GM is currently no longer taking reservations for the GMC Hummer EV, topping out at 90,000, nor is the automaker taking reservations for the 2024 Chevy Blazer EV following the fulfillment of its reservation target.

GM also says its EV business would be “solidly profitable” in 2025, that BrightDrop would reach $1B in revenue in 2023, and that its digital retailing platform for EV sales would save the company $2,000 per vehicle. It also expects to double its revenue by 2030 through new software platforms and connectivity, while adding 50 new in-vehicle digital services by 2026, creating a wealth of new potential revenue streams. To help ramp up EV production, agreements were announced regarding electric and hydrogen energy sources, as GM will collaborate with Nel ASA on affordable hydrogen production while a long-term deal was inked with Vale for supplying the nickel needed for manufacturing battery packs. GM previously announced a joint venture with POSCO Chemical to process materials for the automaker’s Ultium batteries, plus a joint investment with Lithium Americas for raw battery materials.

Back in 2020, GM CEO Mary Barra shared the company’s plan to launch a total of 30 new electric vehicles globally by 2025, with a total investment of $7 billion. To put that in perspective, 40 percent of GM’s offerings will be fully electric by the end of 2025, compared to just three percent in 2021. GM CEO Mary Barra has also stated that General Motors could catch up to Tesla in EV sales by 2025, while announcing plans to build a new network of charging stations across the U.S. GM will adopt the North American Charging Standard starting in 2025, while GM EV customers will be able to access the Tesla Supercharger network early in 2024. What’s more, GM has made a commitment to phase out fossil fuel vehicles by 2040.

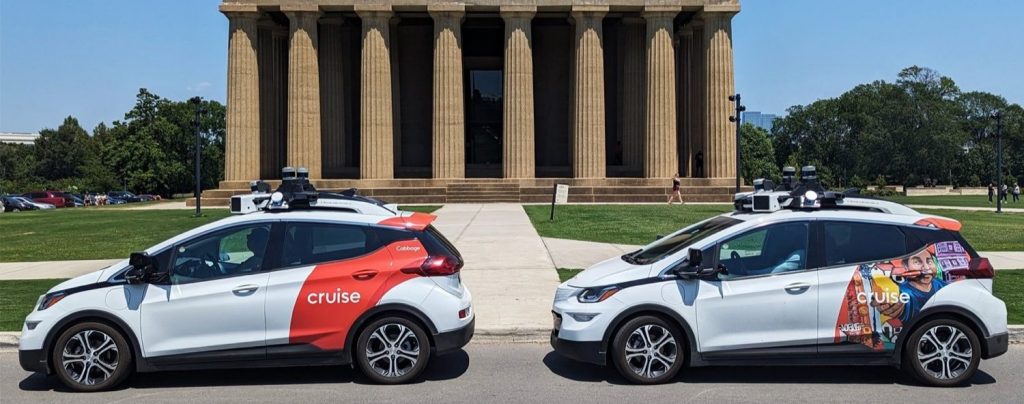

With regard to EV and AV investments, GM has earmarked a total of $35 billion between now and 2025. GM’s Cruise autonomous vehicle brand is expected to rake in $50 billion over the coming years, with the finalization of autonomous vehicle rules from the NHTSA paving the way for GM to launch a fleet of new self-driving ride-share vehicles. Cruise division is now seeking to test the fully autonomous Cruise Origin without a steering wheel or pedals on the streets of San Francisco. SoftBank previously announced a further $1.35 billion investment in GM’s Cruise AV arm. The Cruise AV division reported a $500 million loss for Q2 of 2022. Cruise reports that it is currently operating roughly 400 AVs on city streets, passing the 3,000,000 driverless mile traveled mark as it expands driverless rides to Houston and Dallas, as well as Miami, Florida, Nashville, and North Carolina. The new Cruise Origin AV is expected to hit production in the next few days. However, the company has come under fire as its AVs allegedly blocked first responders from transporting a patient to the hospital, which Cruise has denied.

With regard to its private passenger vehicle semi-autonomous products, GM doubled the size of its current Super Cruise road network, and the company’s full-size SUVs including the Chevy Tahoe and the Chevy Suburban were the first models built with the updated Super Cruise software. Units equipped with driver assist system already on the road will receive an over-the-air update.

Some investors are coming around to GM, with GM CEO Paul Jacobson purchasing 35,000 shares of GM stock in April 2022 and another 31,000 shares in May 2023, much more than was required by his executive position, and Cathie Wood’s Arc Invest Firm also purchasing shares after Wood criticized GM’s move towards EVs. Morgan Stanley also upgraded its outlook for GM stock value from Equal-Weight to Overweight, and more recently, BofA Securities maintained a buy rating for GM stock following the release of the automaker’s Q2 2023 sales figures, raising the price target to $72. Fitch Ratings has upgraded its rating for GM and GM Financial from BBB- to BBB, indicating the credit agency believes GM has a low chance of default. Nevertheless, Berkshire Hathaway reportedly sold half of its stake in GM during Q2 of 2023.

GM previously issued $2.5 billion in new senior unsecured notes, and recently announced a first quarter 2023 dividend of 9 cents per share on the company’s outstanding shares of common stock.

Finally, GM previously announced a series of job cuts in the United States and abroad, with roughly 500 employees reportedly let go. Additionally, GM has announced that 5,000 employees will take part in a voluntary separation program, while GM cut hundreds of contract workers in a bid to further reduce its operating costs. In addition, 940 jobs were cut following the closure of the GM IT Innovation Center in Arizona.

GM Stock Value Macro Factors – Sales

GM’s Q2 2023 U.S. sales figures were headlined by a 19-percent year-over-year sales increase to 691,978 units. Sales at all four of GM’s U.S. brands increased for the quarter, with retail sales growing 15 percent, and fleet sales growing 34 percent. GM also sold 15,652 EVs during Q2, fewer than the number of GM EVs sold in Q1. GM inventory improved by 4 percent.

GM Q1 2023 sales increased by 18 percent year-over-year in the United States, amounting to 603,208 deliveries, including more than 20,000 EVs, making GM the second-most popular electric vehicle manufacturer behind Tesla, moving out almost twice as many units as Ford during that period.

GM’s Q4 2022 sales figures were marked by a 41-percent year-over-year increase in the U.S. to 623,261 units. Sales increased at Chevrolet, Cadillac, and GMC brands, but decreased at Buick. The new figures brought GM’s total U.S. annual sales to 2.27 million units, besting Toyota’s 2.1 million units sold to once again make GM the number-one automaker in the U.S.

GM’s Q3 2022 sales figures were released in early October, which were highlighted by a sales increase of 24 percent to 555,580 units, with all four of GM’s U.S. brands seeing a sales increase.

GM Q1 2023 Global Deliveries

Vehicle deliveries in thousands.| Q1 2023 / Q1 2022 | Q1 2023 | Q1 2022 | |

|---|---|---|---|

| Global Deliveries | -3% | 1,384 | 1,427 |

| North America | 18% | 707 | 601 |

| - U.S.A | 18% | 603 | 513 |

| Asia/Pacific, Middle East and Africa | -22% | 572 | 736 |

| - China | -25% | 462 | 613 |

| South America | 17% | 105 | 90 |

| - Brazil | 42% | 71 | 50 |

GM Stock Value Macro Factors – Earnings

General Motors’ Q2 earnings report was highlighted by $44.7 billion in revenue, $2.6 billion in net income attributable to stockholders, and EBIT-adjusted of $3.2 billion. The results included a $792 million charge for new commercial agreements with LG Electronics and LG Energy Solution to cover the Chevy Bolt EV and Bolt EUV recall. GM also updated its full-year guidance, forecasting U.S. GAAP net income attributable to stockholders of $9.3 billion to $10.7 billion (as compared to $8.4 billion to $9.9 billion), EBIT-adjusted of $12.0 billion to $14.0 billion (compared to $11 billion to $13 billion), U.S. GAAP net automotive cash from operating activities of $18.0 billion to $21.0 billion (compared to $16.5 billion to $20.5 billion), and adjusted free cash flow of $7.0 billion to $9.0 billion (from $5.5 billion to $7.5 billion). Capital expenditures are expected at $11 billion to $12 billion, compared to $11 billion to $13 billion.

General Motors’ Q1 2023 earnings were highlighted by $2.4 billion in net income on $40.0 billion in revenue, for an EPS diluted of $1.69. CEO Mary Barra cited strong results due to “healthy customer demand, our intense focus on operational excellence, and great teamwork between GM, our dealers, our suppliers and our unions.”

The release of GM’s Q4 2022 earnings was headlined by $2.0 billion in net income on $43.1 billion in revenue. Compared to the fourth quarter of 2021, these results are a 17.6-percent improvement in net income and 28-percent increase in revenue. GM cited “wholesale volume growth and robust pricing across the portfolio,” which was partially offset by “mix normalization, commodity costs, and GMF [GM Financial] EBT lower” than last year.

GM’s Q3 2022 financial results were highlighted by a record $41.9 billion in revenue and EBIT-adjusted of $4.3 billion, with GM reaffirming its full-year earnings guidance. Analysts, however, are expecting a significant decline in profits next year in the wake of a projected weakening in consumer demand.

GM Q1 2023 Earnings Summary

1. EPS-diluted-adjusted includes $0.03 impact from revaluation on equity investments in Q1 23 and $(0.11) in Q1 22| METRIC | UNIT | Q1 2023 | Q1 2022 | CHANGE | % CHANGE |

|---|---|---|---|---|---|

| GAAP METRICS | |||||

| NET REVENUE | BILLION USD | $39,985.0 | $35,979.0 | $+4,006.0 | +11.1% |

| NET INCOME ATTRIBUTED TO STOCKHOLDERS | BILLION USD | $2,395.0 | $2,939.0 | $-544.0 | -18.5% |

| NET INCOME MARGIN | PERCENT | 6.0% | 8.2% | -2.2% | N/A |

| EARNINGS PER SHARE (EPS) DILUTED | USD PER SHARE | $1.69 | $1.35 | $+0.34 | +25.2% |

| NON GAAP METRICS | |||||

| EBIT-ADJUSTED | BILLION USD | $3,803.0 | $4,044.0 | $-241.0 | -6% |

| EBIT-ADJUSTED MARGIN | PERCENT | 9.5% | 11.2% | -1.7% | N/A |

| ADJUSTED AUTOMOTIVE FREE CASH FLOW | BILLION USD | -$132.0 | $6.0 | -$138.0 | -2300% |

| EPS DILUTED - ADJUSTED1 | BILLION USD | $2.21 | $2.09 | $+0.1 | +5.7% |

| DELIVERIES | MILLIONS OF VEHICLES | 1,384 | 1,427 | -43 | -3% |

| MARKET SHARE | PERCENT | 8.6% | 9.0% | $-0.004 | N/A |

| DIVISIONAL RESULTS | |||||

| GM NORTH AMERICA EBIT-ADJUSTED | BILLION USD | $3,576.0 | $3,141.0 | $+435.0 | +13.8% |

| GM INTERNATIONAL EBIT-ADJUSTED | BILLION USD | $347.0 | $328.0 | $+19.0 | +5.8% |

| GM CHINA EQUITY INCOME | BILLION USD | $0.1 | $0.2 | $-0.1 | -50% |

| CRUISE EBIT-ADJUSTED | BILLION USD | $0.0 | $0.0 | $0.0 | 0% |

| GM FINANCIAL EBT-ADJUSTED | BILLION USD | $0.8 | $1.3 | $-0.5 | -38.5% |

GM Stock Value Macro Factors – Products

GM is now pivoting to all-electric power, recently debuting several important EV models, including the 2025 Cadillac Escalade IQ, the 2024 Chevy Equinox EV, the 2024 GMC Sierra EV Denali Edition 1, the 2024 Chevy Blazer EV, and the Cadillac Celestiq. GM Energy is also launching new Ultium Home charging bundles. Over in China, consumers are embracing the all-new Buick Electra E5 electric crossover with more than 8,000 orders pouring in over the first 10 days it went on sale.

However, the automaker still has a wealth of ICE-powered vehicles on offer, unveiling its new flagship heavy duty off-roader model, the Chevy Silverado HD ZR2 and Chevy Silverado HD ZR2 Bison. Further ICE-based reveals include the 2024 Buick Envista crossover, the all-new 2023 Chevy Colorado, the 2023 Chevy Tahoe RST Performance Edition, the refreshed 2024 Chevy Silverado HD, the 2024 Chevy Trax crossover, the 2024 GMC Sierra HD, and the all-new 2023 GMC Canyon, and the GMC Canyon AT4X AEV Edition. GM has also unveiled the new 2024 Corvette E-Ray, the first-ever hybrid-electric Corvette model, plus the 2025 Cadillac CT5 and the 2024 GMC Acadia at the 2023 North American International Auto Show.

GM is now offering the BrightDrop Zevo 600 all-electric light commercial vehicle, formerly known as the BrightDrop EV600. The new van is the fastest-developed vehicle in GM history. The Zevo 600 will be joined by the smaller BrightDrop Zevo 400. Merchant Fleet recently placed an order for 5,400 units of the new Zevo 400, previously known as the BrightDrop EV410. Full-scale production of the BrightDrop vans is underway now at the GM CAMI plant in Canada. BrightDrop has also announced that it has expanded its business to Canada.

GM Stock Value Macro Factors – Events

The global microchip shortage affected GM stock value by impacting production, vehicle supply, and pricing, with production pauses for the Chevy Bolt EV and Bolt EUV, as well as a production pause for the Chevy Camaro, Cadillac CT4, and Cadillac CT5. GM is gearing up to make significant changes to its supply chain in the hopes of avoiding future shortages. That includes the development of new microcontrollers, with GM CEO Mary Barra stating GM is expected to launch its own line of chips by 2025. In January of the 2022 calendar year, the Biden Administration pushed Congress to pass a $52 billion microchip production bill aimed at alleviating the ongoing shortage.

GM Stock Value Micro Factors

The General previously announced that LG Electronics Inc. has agreed to cover $1.9 billion of the $2 billion in costs associated with the replacement of the recalled Chevy Bolt EV and Chevy Bolt EUV battery packs. General Motors has also announced a new battery software update for the recalled Chevy Bolt EV and EUV.

GM also announced that it will replace the battery modules on roughly 50,000 units of the 2017 though 2019 Chevy Bolt EV affected by a potential fire risk. The automaker later decided to extend the battery replacement on all model years of the Bolt EV, in addition to the all-new Bolt EUV. Despite the fault lying with battery producer LG Energy Solution, GM CEO Mary Barra announced that GM will continue its relationship with LG going forward. The National Highway Traffic Administration (NHTSA) recently closed its investigation into the recent Chevy Bolt and Bolt EUV fires, while Chevy Bolt production has since restarted.

In other legal news, GM has issued a recall for hundreds of thousands of units of the Buick Enclave, GMC Acadia, and Chevy Traverse as the result of potentially dangerous airbag inflators.

Previously, GM was hit with a $102 million verdict in a lawsuit concerning its 5.3L V8 engine, while more than 95,000 GM vehicles were recently recalled for faulty rearview cameras. A lawsuit against GM regarding the automaker’s eight-speed automatic transmission has also been granted class action status in the United States, while two more lawsuits were filed in May 2023 in Canada.

Several GM EVs will be eligible for tax credits under the Inflation Reduction Act, which went into effect on April 18th. According to GM, five Ultium-based models on sale before the end of 2023 will qualify for the full EV credit of up to $7,500. Very strict new vehicle emissions standards for the upcoming 2027 through 2032 model years further incentivize EV sales, as outlined by the NHTSA. EVs are expected to account for 66 percent of the vehicle sales by 2035. The SAE has also announced that it will work to further standardize the NACS following GM’s announcement that it will adopt the charger type.

In further political news, California can once again set its own emissions guidelines, while the Biden administration is urging automakers to ensure that their vehicle lineups consist of at least 40 percent EVs by 2030. California has also finalized plans to ban the sale of new ICE-powered vehicles by 2035. Meanwhile, Biden has signed an executive order calling for an end to the purchase of fossil fuel fleet vehicles by 2035. The Biden Administration plans to roll out a $100 billion plan for new EV rebates.

The biggest factor affecting GM stock value in the last month is the ongoing contract negotiations with the UAW labor union. The UAW has filed an unfair labor practice charge against GM accusing the automaker of not negotiating in good faith, a charge which GM has denied. It is estimated that the UAW’s demands may add $80 billion to GM’s labor costs. A recent expansion of the strike now includes GM distribution centers, while GM is idling Malibu and XT4 production as a result of the strike. President Biden was set to send a team to assist in negotiations, but officials later said they would sit in digitally instead.

The latest developments include an expansion to the strike to include the GM Lansing Delta Township plant in Michigan, which builds the Chevy Traverse and Buick Enclave. UAW picketers were struck by a car outside outside the GM Flint Processing center this week, resulting in several contractors being banned from GM property. UAW President Fain has accused GM of hiring violent scabs. GM has also reportedly asked salaried workers to cross picket lines at parts distribution centers.

President Biden visited a picket line at the GM Willow Run Distribution center, voicing support for workers, while former president Donald Trump held a rally in Michigan, saying the EV transition was a “hit job” on Michigan.

Now in 2023, GM stock value opened around $34 per share in January, rising to $39.45 per share in February. In March, GM stock value began a steady decline back towards the $30-per-share mark, with May opening at $34 per share. Stock value opened at $32.49 per share in June, later holding steady under $40 per share, opening at $38.04 per share in August. GM stock value declined through August to open at $33.59 per share in September, and now in October, hovers around $30 per share.

| Month | Opening Value |

|---|---|

| January 3rd | $34.02 |

| February 1st | $39.45 |

| March 1st | $38.68 |

| April 3rd | $36.38 |

| May 1st | $34.00 |

| June 1st | $32.49 |

| July 3rd | $38.74 |

| August 1st | $38.04 |

| September 1st | $33.59 |

| October 2nd | $32.84 |

We’ll continue to stay on top of all the latest developments related to GM stock, so be sure to subscribe to GM Authority for ongoing GM stock news and complete GM news coverage.

Comments

BIDENOMICS!

oooops. quick raise msrp again. that will fix it!

Please don’t give them any ideas…

🙂

you are right. make the destination charge 2999 instead :))

meanwhile i can ship from stockton ca to ft myers fl for 750 a full size sedan (ct6 sized)

Mary must go.

Warren buffet dumped all his GM stock. Economist predict GM will be out of business or bought out in 10 years.

Go ahead, ruin the economy with your unrealistic demands. We can buy from other countries.

other countries make tahoes silverados etc? do tell which one

nobody makes what gm makes. ford suvs are absolute fail and their trucks are equipped with civic sized engines. bruh

dodge has no suvs that compare and the trucks require a new transmission every 2 weeks. (buy in bulk, save!)

so you see, we are stuck with gm

You are correct, no other country makes Tahoes and Silverados, because they are GM products, “bruh”. Toyota’s looking pretty good right now.

Should have sold when it hit $60. No v6 in Traverse, anemic 3cyls, 3 1/2 ton curb weight ev pickup, etc.

With the disgraceful stock performance Mary she owe GM money instead of collecting millions