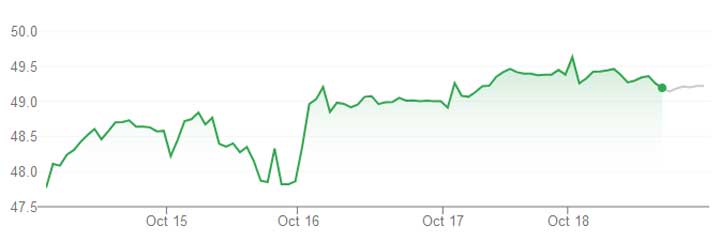

The value of GM stock increased during the week of October 14th to October 18th, 2024. Shares closed the week at $49.18 per share, representing an increase of $1.31 per share, or 2.74 percent compared to the previous week’s closing value of $47.37 per share.

| Date | Open | Close/Last | High | Low |

|---|---|---|---|---|

| 10/18/2024 | $49.64 | $49.18 | $49.75 | $49.10 |

| 10/17/2024 | $49.00 | $49.38 | $49.49 | $48.64 |

| 10/16/2024 | $48.49 | $49.01 | $49.27 | $48.36 |

| 10/15/2024 | $48.22 | $47.85 | $48.91 | $47.81 |

| 10/14/2024 | $47.75 | $48.63 | $48.77 | $47.63 |

By comparison, shares of GM’s crosstown rival, Ford Motor Company, were up 3.54 percent, or $0.38 per share, during the same timeframe.

GM Stock Factors

GM stock value was on the rise again this week after a five-percent jump last week, preceded by a seven-percent drop over the previous two weeks combined.

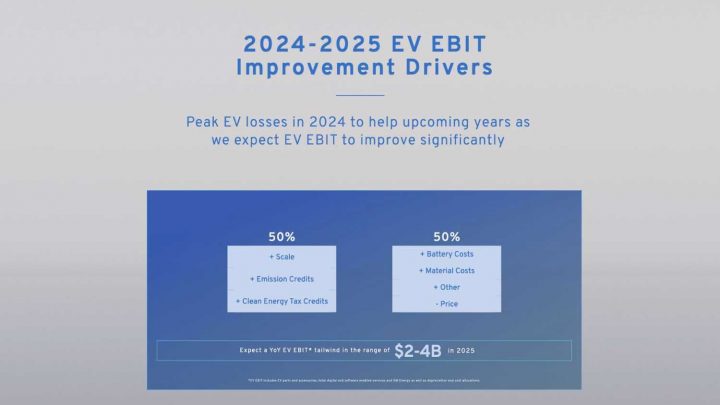

The biggest factors affecting GM stock value this week include the speculation that the automaker could use lower-cost LFP battery technology in its fully electric trucks, as announced during the Investor Day presentation. At the event, president Mark Reuss also stated that GM has a business case in entry-level vehicle segments, unlike some competitors who have given up on them, while CFO Paul Jacobson outlined that the company would reach variable positive profit with its lineup of EVs in the fourth quarter of 2024. In addition, GM Senior Vice President, Software and Services Engineering, David Richardson, said OnStar would expand its reach to become GM’s eCommerce platform.

On the product side of things, production of the all-new 2025 Cadillac Optiq, the 2025 Chevy Traverse, the refreshed 2025 Chevy Tahoe and Suburban, the refreshed 2025 GMC Yukon and the refreshed 2025 Cadillac Escalade have all started.

On the supplier front, GM chips provider Wolfspeed obtained a $750M grant from the U.S. Government, and battery component supplier Aspen Aerogels obtained a $671 loan from the U.S. Meanwhile, GM Ventures announced a $10M investment in Forge Nano for battery material coating, while GM injected $625M into the Thacker Pass mine joint venture with Lithium Americas.

Also, GM officialised the 2025 Corvette ZR1’s top speed at 233 mph, reached on a racetrack in Germany with president Mark Reuss at the helm.

On the downside, the automaker released sales figures for its GM China operations, dropping 21 percent in the third quarter of 2024.

GM Stock Value Macro Factors – Strategy

General Motors continues to drive towards the mass adoption of all-electric vehicles, laying out its ambitious global future growth strategy in 2022 and reaffirming its commitment to deploying zero-emission and autonomous technologies around the world. GM has also announced several major investments, including a massive $7 billion for its Michigan-based production facilities that includes $4 billion to convert the Orion Township plant for production of the new Chevy Silverado EV and Sierra EV, $2.5 billion for a third Ultium Cells battery plant, and a further $500 million to support production of the next-generation Chevy Traverse and Buick Enclave. The $7 billion investment is the largest single investment in GM history, and prompted responses from the White House, among other groups.

Earlier this year, GM finalized an $18.6 billion deal with LG Energy Solution to secure hundreds of thousands of tons of cathode materials for battery production. GM CEO Mary Barra has stated that production of the automaker’s Ultium battery modules has increased 300 percent in the last six months. General Motors and Samsung SDI recently finalized a deal to build a new EV battery production plant in Indiana. During Investor Day presentation on October 8th, 2024, GM announced that it will drop the Ultium brand as it relates to its battery and drive motor technology, as the company will explore new battery technology opportunities with other partners, but will keep the Ultium Cells branding for its battery cell manufacturing joint venture with LGES.

GM has also announced a round of investments totaling $918 million benefitting four GM’s U.S.-based production facilities, including $579 million for the GM Flint Engine plant in Michigan, $216 million for the GM Bay City GPS plant in Michigan, $68 million for the GM Rochester plant in New York, and $55 million for the GM Defiance plant in Ohio. The investments will support production of GM’s next-gen Small Block V8 gasoline engine, as well as EV production.

Further investments include $1 billion for two Flint-area GM production facilities and a C$280 investment for the GM Oshawa plant in Canada, all of which will support next-gen HD truck production, plus a $500 million investment for the GM Arlington plant to support-next-gen SUV production, $632 million for the GM Fort Wayne plant to support next-gen ICE-based pickup production, as well as $920 million for the DMAX plant in Brookville to support next-gen ICE-based HD truck production. Additionally, the Biden administration has announced a $500 million grant to support EV production at the GM Lansing Grand River plant in Michigan.

Outside the U.S., GM has announced a $1.4 billion investment cycle for Brazil, the largest and most commercially strategic country in South America.

GM has said its EV business will be “solidly profitable” by 2025 and that its digital retailing platform for EV sales would save the company $2,000 per vehicle. It also expects to double its revenue by 2030 through new software platforms and connectivity, while adding 50 new in-vehicle digital services by 2026, creating a wealth of new potential revenue streams. The automaker’s Winning with Simplicity initiative is increasing efficiency and profit, with examples of savings such as the deletion of 2,700 unique parts. GM also expects to save upwards of $6,000 per EV unit through the use of new LFP battery technology.

Back in 2020, GM CEO Mary Barra shared the company’s plan to launch a total of 30 new electric vehicles globally by 2025, with a total investment of $7 billion. To put that in perspective, 40 percent of GM’s offerings will be fully electric by the end of 2025, compared to just three percent in 2021. GM CEO Mary Barra has also stated that General Motors could catch up to Tesla in EV sales by 2025, while announcing plans to build a new network of charging stations across the U.S. GM will adopt the North American Charging Standard starting in 2025. GM EVs now have access to the Tesla Supercharger network, although an adapter is required to connect and some Chevy Bolt EV owners will first require a software update. What’s more, GM has made a commitment to phase out fossil fuel vehicles by 2040.

That all said, The General is now shifting its electrification strategy. GM scrapped its goal of production 400,000 EVs by mid-2024, with plans to instead build between 200,000 and 300,000 EVs in North America during the 2024 calendar year, and revising that number to about 200,000 units produced by the time the 2024 calendar year comes to a close. GM is also eyeing a change to its 1-million EV production capacity target. Cadillac has announced it will not fully transition to all-electric powertrains by 2030 as originally anticipated, but it will not offer plug-in hybrids in North America like GM’s other brands.

GM’s Cruise LLC autonomous vehicle division previously announced a pause of its driverless operations across all its fleets following the state of California’s decision to suspend the robotaxi company’s driverless permits while the NHTSA investigates, among other incidents, an accident during which a Cruise AV ran over and dragged a pedestrian before coming to a stop. Cruise is on the hook for $112,500 as a result of the incident. Cruise has also released an independent study explaining what happened, and the city of San Francisco has also filed a lawsuit targeting Cruise’s AV fleet. Cruise recently reached a settlement with the pedestrian trapped underneath the AV in the accident, while the automaker has decided to inject another $850 million into the subsidiary in extra funding. Cruise is now doubling down on safety, and has resumed vehicle testing in California this Fall.

Just before this turn of events, Cruise reached the 5 million driverless mile mark. GM has since announced that it will scale back its ambitions with Cruise, a move expected to significantly reduce the division’s operating costs. Cruise co-founder and CEO Kyle Vogt resigned in November of 2023, as did company co-founder and CPO Daniel Kan. Earlier this year, the company’s hardware chief resigned, and the company also appointed a new safety chief.

After launching a fleet of AVs in Phoenix, Arizona, Cruise vehicles are now back on the streets of Dallas for human-supervised driving.

Some investors are coming around to GM, with BofA Securities maintaining a buy rating for GM stock following the release of the automaker’s Q2 2023 sales figures, raising the price target to $72. Fitch Ratings has upgraded its rating for GM and GM Financial from BBB- to BBB, indicating the credit agency believes GM has a low chance of default. Nevertheless, Berkshire Hathaway reportedly sold half of its stake in GM during Q2 of 2023, and unloaded its remaining stock in November 2023. In addition, some investors are questioning the viability of Cruise, GM’s autonomous vehicle technology division. In September 2024, Morgan Stanley downgraded GM’s stock from “underweight” to “equal weight,” resulting in an immediate stock price drop of 4.87 percent.

Finally, GM announced last year that 5,000 employees would take part in a voluntary separation program, while hundreds of contract workers were let go in a bid to further reduce operating costs. In addition, 940 jobs were cut following the closure of the GM IT Innovation Center in Arizona, and a further 1,314 workers were let go following the discontinuation of the Chevy Camaro, the first-gen Chevy Bolt EV and the first-gen Chevy Bolt EUV. Meanwhile, the Cruise LLC robotaxi division laid off roughly 900 employees, representing 24 percent of its workforce, in addition to firing nine company leaders. The General is also cutting its workforce in China, while a new president has been appointed at the SAIC-GM joint venture amid a restructuring effort.

GM has also announced that it is moving its global headquarters to the new Hudson’s Detroit development in downtown, while GM CEO Mary Barra has expressed confidence that a solution will be found for the GM Renaissance Center the automaker will vacate next year.

GM stock value increased sharply in February following the declaration of the first quarter 2024 dividend in the amount of $0.12 per share, a 33-percent increase from the previous quarterly dividend. Late in November, 2023, GM announced a $10 billion share repurchase program and 33-percent dividend increase, which catapulted GM stock value with a 12-percent boost. More recently, GM’s Board of Directors approved an additional $6 billion share buyback program.The 2023 announcement was made in conjunction with new earnings guidance, which included an estimated loss of $1.1 billion due to the UAW strike. GM also stated that it expects vehicle production costs to rise $500 per vehicle in conjunction with the new UAW contract inked last year. GM declared a $0.12 dividend for Q2 of 2024, as well as for the third quarter of 2024.

GM Stock Value Macro Factors – Sales

GM’s Q3 2024 sales figures were highlighted by a 2.2-percent overall decreased in the U.S. market, though three out of the four GM brands actually posted gains. The good news was a sharp rise in EV sales, increasing by 60 percent year-over-year and by 46 percent compared to Q2 2024.

GM’s Q2 2024 sales figures were highlighted by a slight 0.6-percent increase in the U.S., with sales rising at Buick and GMC, but declining at Chevrolet and Cadillac. Total sales for the quarter amounted to 696,086 units.

GM’s Q1 2024 sales figures were highlighted by a 1.5-percent decrease to 594,233 units for the quarter. Sales increased at Buick, but decreased at Chevy, Cadillac, and GMC brands. Q1 recorded 256 deliveries for BrightDrop, as well. GM Envolve (fleet) sales fell 23 percent.

GM’s Q4 2023 sales figures were highlighted by a 0.3-percent increase to 625,176 units for the quarter. Sales increased at Buick, but decreased at Chevy, Cadillac, and GMC brands. The General has also released final sales figures for the 2023 calendar year, which were up 14-percent to 2,549,698 units.

GM Q1 2024 Global Deliveries

Vehicle sales in hundreds of thousands of units (000)| Q1 2024 / Q1 2023 | Q1 2024 | Q1 2023 | |

|---|---|---|---|

| Global Deliveries | -2.5% | 1,347 | 1,382 |

| North America | +0.3% | 709 | 707 |

| - U.S.A | -1.5% | 594 | 603 |

| Asia/Pacific, Middle East and Africa | -2.8% | 554 | 570 |

| - China | -4.5% | 441 | 462 |

| South America | -20.8% | 84 | 106 |

| - Brazil | -19.7% | 57 | 71 |

GM Stock Value Macro Factors – Earnings

GM’s Q2 2024 financial results were headlined by $48.0 billion in revenue, net income attributable to stockholders of $2.9 billion, and EBIT-adjusted of $4.4 billion. GM also updated its 2024 full-year earnings guidance, with anticpated capital spending of $10.5 billion to $11.5 billion, including investments into the company’s battery cell production.

GM’s Q1 2024 earnings were headlined by $2.9 billion in net income on $43 billion in revenue, a 24.4-percent increase in net incoming and 7.6-percent increase in revenue compared to Q1 of 2023. The performance included a net income margin of 6.9 percent, which was up 0.9 percent from 6.0 percent in Q1 or the 2023 calendar year. Meanwhile, Earnings per Share (EPS) diluted increased to $2.56, a jump of $0.87 from $1.69 during Q1 of 2023.

GM’s Q4 2023 earnings were headlined by $2.1 billion in income and $43 billion in revenue, representing a 5.2-percent increase in net income and 0.3-percent decrease in revenue. Earnings for the 2023 calendar year amounted to $10.1 billion in income and $171.8 billion in revenue. The performance represents a net income margin of 4.9 percent, a decrease of 0.3 percentage points from 4.6 percent in Q4 of 2022. Earnings per share (EPS) diluted was $1.59, up $0.20 from $1.39 compared to Q4 2022.

GM’s Q3 2023 earnings report on October 24th highlighted $3.1 billion in net income on $44 billion in revenue, representing a 7.3 percent decrease in income and a 5.4 percent increase in revenue compared to the third quarter of 2022. GM’s EBIT-adjusted earnings were $3.5 billion, a 16.9 percent or $723 million drop compared to the $4.28 billion figure announced over the same period last year.

GM Q1 2024 Earnings Summary

| METRIC | UNIT | Q1 2024 | Q1 2023 | CHANGE | % CHANGE |

|---|---|---|---|---|---|

| GAAP METRICS | |||||

| NET REVENUE | BILLION USD | $43,014 | $39,985 | +$3,029 | +7.6% |

| NET INCOME ATTRIBUTED TO STOCKHOLDERS | BILLION USD | $2,980 | $2,395 | +$585 | +24.4% |

| NET INCOME MARGIN | PERCENT | 6.9% | 6.0% | +0.9 PPTS | N/A |

| EARNINGS PER SHARE (EPS) DILUTED1 | USD PER SHARE | $2.56 | $1.69 | +$0.87 | +51.5% |

| NON GAAP METRICS | |||||

| EBIT-ADJUSTED | BILLION USD | $3,871 | $3,803 | +$68 | +1.8% |

| EBIT-ADJUSTED MARGIN | PERCENT | 9.0% | 9.5% | -0.5 PPTS | N/A |

| AUTOMOTIVE OPERATING CASH FLOW | BILLION USD | $3,598 | $2,232 | +$1,366 | +61.2% |

| ADJUSTED AUTOMOTIVE FREE CASH FLOW | BILLION USD | $1,090 | -$132 | +$1,222 | +925.8% |

| EPS DILUTED - ADJUSTED1 | BILLION USD | $2.62 | $2.21 | +$0.41 | +18.6% |

| DELIVERIES | MILLIONS OF VEHICLES | 1,347 | 1,382 | -35K | -2.5% |

| GLOBAL MARKET SHARE (IN GM MARKETS) | PERCENT | 8.1% | 8.7% | -0.6 PPTS | N/A |

| DIVISIONAL RESULTS | |||||

| GM NORTH AMERICA EBIT-ADJUSTED | BILLION USD | $3,840 | $3,576 | +$264 | +7.4% |

| GM INTERNATIONAL EBIT-ADJUSTED | MILLION USD | -$10.0 | $347 | -$357 | -102.9% |

| GM CHINA EQUITY INCOME | MILLION USD | -$106 | $83.0 | -$189 | -227.7% |

| CRUISE EBIT-ADJUSTED | MILLION USD | -$0.4 | -$0.6 | +$0.2 | +33.3% |

| GM FINANCIAL EBT-ADJUSTED | MILLION USD | $737 | $771 | -$34 | -4.4% |

GM Stock Value Macro Factors – Products

GM is now pivoting to all-electric power, debuting several important new EV models, including the 2025 Cadillac Escalade IQ, the 2024 Chevy Equinox EV, the 2024 GMC Sierra EV Denali Edition 1, the 2024 Chevy Blazer EV, the Cadillac Celestiq, the 2025 Cadillac Optiq, and the 2026 Cadillac Vistiq. GM Energy is also launching new Ultium Home charging bundles. Over in China, consumers are embracing the all-new Buick Electra E5 electric crossover with more than 8,000 orders pouring in over the first 10 days it went on sale. GM Senior Vice President and President of Global Markets leadership team Marissa West said the upcoming 2026 Chevy Bolt EV will be the most affordable electric vehicle in the U.S. when it launches in 2025.

During the Q3 2023 earnings presentation, CEO Mary Barra stated that adjustments to the automaker’s software integration strategy would require pushing back the launch of the Chevy Equinox EV, Chevy Silverado EV RST and GMC Sierra EV Denali by a few months. On October, 25th, Honda announced that it was no longer collaborating with GM on affordable electric vehicles, a plan that was initially announced in April 2022.

However, the automaker still has a wealth of ICE-powered vehicles on offer, unveiling its new flagship heavy duty off-roader model, the Chevy Silverado HD ZR2 and Chevy Silverado HD ZR2 Bison. Further ICE-based reveals include the 2024 Buick Envista crossover, the all-new 2025 Buick Enclave, the all-new 2023 Chevy Colorado, the 2023 Chevy Tahoe RST Performance Edition, the refreshed 2024 Chevy Silverado HD, the 2024 Chevy Trax crossover, the 2024 GMC Sierra HD, the all-new 2023 GMC Canyon, the GMC Canyon AT4X AEV Edition, the new 2024 Corvette E-Ray, the new 2025 Corvette ZR1, the 2025 Cadillac CT5, the 2024 GMC Acadia, the refreshed 2025 Chevy Tahoe and 2025 Chevy Suburban, the 2025 Chevy Equinox, the 2025 Chevy Silverado HD Trail Boss package, and the refreshed 2025 Cadillac Escalade.

In November 2023, GM announced that BrightDrop would now be fully integrated with GM, rather than a wholly owned subsidiary, saving money, and in August 2024, the automaker confirmed that the BrightDrop Zevo would become the Chevy BrightDrop. In addition, the much-anticipated Chevy Equinox EV has now arrived in dealers and customer deliveries are under way.

GM Stock Value Macro Factors – Events

The global microchip shortage affected GM stock value by impacting production, vehicle supply, and pricing, with production pauses for the Chevy Bolt EV and Bolt EUV, as well as a production pause for the Chevy Camaro, Cadillac CT4, and Cadillac CT5. GM is gearing up to make significant changes to its supply chain in the hopes of avoiding future shortages. That includes the development of new microcontrollers, with GM CEO Mary Barra stating GM is expected to launch its own line of chips by 2025. In January of the 2022 calendar year, the Biden Administration pushed Congress to pass a $52 billion microchip production bill aimed at alleviating the ongoing shortage. GM announced in February of 2024 that it had cleared its backlog of vehicles waiting on rail shipment.

In South America, workers in GM Brazil’s assembly plants went on strike in October 2023 in protest of recent layoffs, affecting production for vehicles destined for the South American market.

The biggest factor affecting GM stock value in the fall of 2023 was the contract negotiation with the UAW labor union, as well as the associated labor strike. Before the UAW-GM contract agreement was ratified by union workers, strikes crippled production at the GM Wentzville plant in Missouri that builds the Chevy Colorado, the GMC Canyon, the Chevy Express and the GMC Savana, the GM Lansing Delta Township plant in Michigan that builds the Chevy Traverse and Buick Enclave, as well as at the GM Arlington plant in Texas that manufactures the Chevy Tahoe, the Chevy Suburban, the GMC Yukon and the Cadillac Escalade.

The General’s 18 parts distribution centers across the United States were also impacted by the UAW strike, with a ripple effect pushing General Motors to halt Chevy Malibu and Cadillac XT4 production at its Fairfax, Kansas assembly plant, in addition to laying off workers at various parts production plants. All facilities impacted by the strike were up and running again from early November 2023 onwards.

More recently, a significant cyberattack against CDK Global impacted car dealers across the nation, affecting business for weeks afterwards. Services were restored the week of the July 4th holiday, although the attack is estimated to have cost $1 billion in lost business.

GM Stock Value Micro Factors

Previously, very strict new vehicle emissions standards for the 2027 through 2032 model years were released to further incentivize EV sales, as outlined by the NHTSA. However, further revisions to the fuel economy standards are now expected to relax requirements somewhat. The SAE has also announced that it will work to further standardize the NACS following GM’s announcement that it will adopt the charger type.

In further political news, California can once again set its own emissions guidelines, while the Biden administration is urging automakers to ensure that their vehicle lineups consist of at least 40 percent EVs by 2030. The Biden administration has also announced that Chinese-made EVs will face a 100-percent import tariff, and in September 2024, it proposed a ban on Chinese-made vehicle software and hardware, potentially affecting availability of the Chinese-built Buick Envision in North America.

Meanwhile, the Biden administration plans to roll out a $100 billion plan for new EV rebates, as well as $653 million in grants to expand the EV charging network in the U.S. Rumor has it the Biden administration is also poised to ease restrictions promoting EV adoption.

In legal news, GM has filed a lawsuit against the city of San Francisco seeking $121 million in back taxes and penalties, with the automaker alleging that the city inflated its tax bill by incorrectly including Cruise, GM’s autonomous vehicle division, in tax calculations. GM is also facing a new lawsuit alleging the automaker broke privacy laws by selling driver data to data brokers, which in turn sold that data to insurance companies. U.S. senators are asking the FTC to investigate the issue. The state of Texas is also suing GM over the issue.

In 2023, GM stock value opened around $34 per share in January, rising to $39.45 per share in February. In March, GM stock value began a steady decline back towards the $30-per-share mark, with May opening at $34 per share. Stock value opened at $32.49 per share in June, later holding steady under $40 per share, opening at $38.04 per share in August. GM stock value declined through August to open at $33.59 per share in September. It opened at $32.84 in October, only to dip below the $30 mark for the first time in three years on October 5th. GM stock value opened at $28.73 per share in November. GM stock value hit a new low on November 10th, bottoming out at $26.30 per share before rising to $26.85 per share by the end of trading for the day.

Now in 2024, GM stock opened in January around $35 per share, rising to a little over $39 per share in February and opening over $40 per share in March. Stock value was up to $45.13 by April, falling slightly to $44.50 in May and rising to $44.96 in June and $46.68 in July. Stock value opened at $44.61 in August and $49.15 in September, edging towards the $50-per-share mark.

| Month | Opening Value |

|---|---|

| January 2nd | $35.64 |

| February 1st | $39.18 |

| March 1st | $40.80 |

| April 1st | $45.13 |

| May 1st | $44.50 |

| June 3rd | $44.96 |

| July 1st | $46.52 |

| August 1st | $44.61 |

| September 3rd | $49.15 |

| October 1st | $45.15 |

No Comments yet