The value of GM stock decreased during the March 16th, 2020 to March 20th, 2020 timeframe. Shares closed the week at $18.14 per share, which represents a decrease of $6.57 per share, or 27 percent, compared to last week’s closing value of $24.71.

Movements in GM stock value for the week were as follows:

- Monday, March 16th: General Motors stock opened at $21.51 and closed at $21.00

- Tuesday, March 17th: GM stock opened at $21.31 and closed at $20.32

- Wednesday, March 18th: GM stock opened at $18.83 and closed at $16.80

- Thursday, March 19th: GM stock opened at $16.34 and closed at $17.71

- Friday, March 20th: General Motors stock opened at $18.42 and slipped to $18.14 by market close

The above-average decrease in GM stock value marks the fifth consecutive week of decline, following last week’s drop of 14 percent, which was preceded by 6 and 12 percent drops in the two weeks prior.

Before the downward movement, GM shares experienced two consecutive weeks of growth, which in turn followed two weeks of decline. GM share values have been experiencing this continued ebb and flow since mid-2018, though the performance is ultimately a net loss for GM shareholders. The global impact of the coronavirus is negatively affecting the stock market as a whole.

The impact of the COVID-19 pandemic is not to be understated, as the Big Three domestic auto manufacturers – Ford, FCA, and GM – have ceased production amid the outbreak. That said, there is a notable difference in other key decisions made by the companies. Case in point, Ford reportedly opted to borrow $15.4 billion from its existing credit lines and suspend its dividend, while GM stayed the course. In turn, Ford stock continued to decline, while GM stock recovered from its weekly low of $14.32 experienced on Wednesday.

For context, below is a timeline illustrating all the ways that the coronavirus pandemic has influenced GM operations:

- January 27th: GM Imposes Employee Travel Restrictions

- February 7th: General Motors Chinese Venture Making Masks

- February 11th: Buick Encore GX, Chevrolet Trailblazer Production Halted In South Korea

- February 14th: Concern Grows Over GM’s Truck Business

- February 15th: GM China Resumes Production

- February 28th:

- March 6th: SAIC-GM Sales Plunge 92 Percent

- March 9th:

- March 12th: Projections Show 9 Percent Dip In U.S. Auto Sales

- March 13th: GM Asks Employees To Work From Home

- March 16th:

- March 17th:

- March 18th:

- March 19th:

- March 20th:

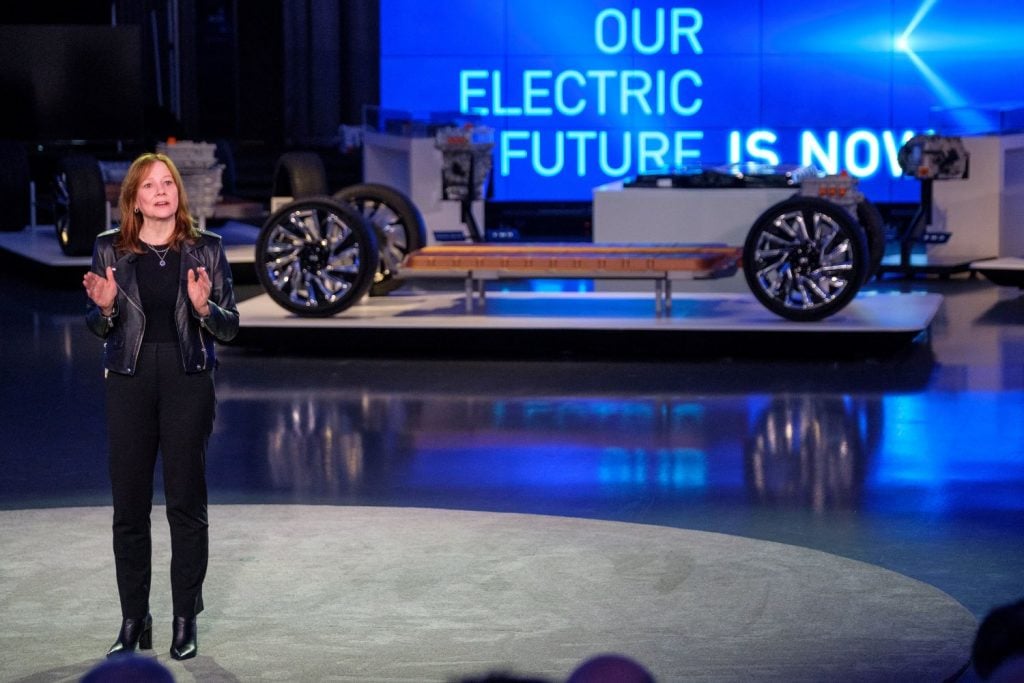

There is some good news, though. A recent analysis shows that GM’s full-size SUVs outsold all rivals combined in 2019. Additionally, new products are on the horizon, including the recently-announced GMC Hummer EV pickup, GM’s advanced new proprietary Ultium batteries, which debuted at GM EV Day in early March, and new modular BEV3 platform, which will underpin the Cadillac Lyriq electric crossover and Cadillac Celestiq electric sedan.

For the most part, GM stock was in limbo throughout most of 2019, and has only faced more adversity in 2020. GM stock saw an initial jump in value as a result of overwhelmingly positive Q2 2019 earnings, wherein the automaker outperformed expectations. Several subsequent drops in value prior to the strike are believed to have been related to warning signs of an economic slowdown, along with various escalations with trade wars in China.

By comparison, shares of GM’s cross-town rival, the Ford Motor Company, decreased $1.30 per share, or 23 percent, this week.

| Date | Open | Close | High | Low |

|---|---|---|---|---|

| 2020/3/20 | 4.54 | 4.33 | 4.75 | 4.25 |

| 2020/3/19 | 4.33 | 4.47 | 4.58 | 4.10 |

| 2020/3/18 | 4.75 | 4.50 | 4.84 | 4.10 |

| 2020/3/17 | 5.08 | 5.01 | 5.14 | 4.70 |

| 2020/3/16 | 5.04 | 5.01 | 5.22 | 5 |

Over the last few years, GM has taken many steps to increase the value of its stock, including exiting markets where it can’t find ways to turn a profit (such as Europe, South Africa and India), closing plants in various parts of the world, divesting loss-making divisions (such as Opel-Vauxhall), making adjustments to its business model in order to prioritize profitability over chasing market-share goals, focusing on its Cadillac luxury brand to increase its share of high-profit automobiles, investing heavily into new-age mobility ventures such as electric vehicles and autonomous driving tech, while discontinuing some sedans (Cruze, Impala, LaCrosse, XTS, CT6) and closing various plants to focus on more profitable crossovers, SUVs and pickup trucks, such as the all-new 2021 Cadillac Escalade that was unveiled on February 4th.

Seeking to further streamline its activities in unprofitable markets, General Motors also announced its intention to phase out the Holden brand in Australia and New Zealand, in addition to pulling the Chevrolet brand out of Thailand and selling its Rayong assembly plant to Great Wall Motors.

Despite these actions, the value of GM stock has struggled to surpass the $40 mark, spending most of its time stuck in the $33-$38 per share range. The chain of events is problematic given that the “new GM” had its Initial Public Offering (IPO) at $33 per share in November 2010, causing frustration upon many investors.

We remain interested in seeing how GM stock performs through the early stages of 2020, especially as the Detroit-based automaker continues the launch of its GEM-based vehicles for developing markets and begins to launch its all-new full-size SUVs and various new Cadillac models this year. In addition, the roll-out of its full-size pickup trucks is now complete, which means the company will benefit from an entire calendar year with a full lineup. All of these products are expected to contribute significantly to GM’s bottom line.

The automaker is also planning to roll out the Cruise Origin, its autonomous ride-sharing vehicle in 2022, which will be built at the GM Detroit-Hamtramck plant in Michigan. GM sees the robo-taxi service as a significant opportunity for growth.

Subscribe to GM Authority for ongoing GM stock news and complete GM news coverage.

Comment

With the current stock price, the “Yield” (dividend) is approaching 10%.

IMHO, that’s an increase in “Value” over the past 30 days, not a decrease…