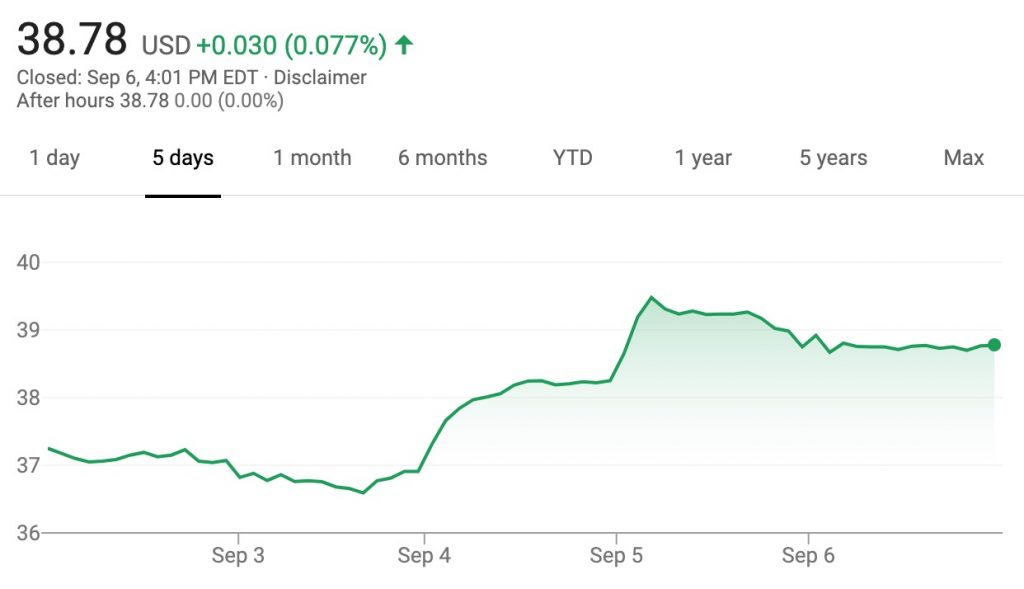

The value of GM stock increased during the September 2nd, 2019 – September 6th, 2019 timeframe. Shares closed the week at $38.78 per share, which represents an increase of $1.69 per share, or 5 percent, compared to last week’s closing value of $37.09.

Movements in GM stock value for the week were as follows:

- Monday, September 2nd: market closed due to Labor Day holiday

- Tuesday, September 3rd: GM stock opened at $36.89 and closed at $36.91

- Wednesday, September 4th: opened at $37.31 and closed at $38.24

- Thursday, September 5th: GM stock opened at $38.62 and closed at $38.73

- Friday, September 6th: General Motors stock opened at $38.86 and fell to $38.78 at market close

This week’s increase in GM stock value is the second consecutive week of positive performance. The rebound comes after four consecutive weeks of declines for GM stock which, in turn, followed a jump in value as a result of GM’s Q2 2019 earnings, wherein the automaker outperformed expectations. The decrease over the previous few weeks is believed to be related to warning signs of an economic slowdown, along with various escalating matters in the ongoing trade war with China.

By comparison, shares of GM’s cross-town rival, the Ford Motor Company, increased 2 percent, or $0.17 per share, this week.

| Date | Open | Close | High | Low |

|---|---|---|---|---|

| 2019/9/6 | 38.86 | 38.78 | 38.93 | 38.52 |

| 2019/9/5 | 38.62 | 38.73 | 39.54 | 38.62 |

| 2019/9/4 | 37.31 | 38.24 | 38.315 | 37.2401 |

| 2019/9/3 | 36.89 | 36.91 | 37.005 | 36.54 |

Over the last few years, GM has taken many steps to increase the value of its stock, including exiting markets where it can’t find ways to turn a profit (such as Europe, South Africa, and India), closing plants in various parts of the world, divesting loss-making divisions (such as Opel-Vauxhall), making adjustments to its business model in order to prioritize profitability over chasing market share goals, focusing on its Cadillac luxury brand to increase its share of high-profit automobiles, investing heavily into new-age mobility ventures such as electric vehicles and autonomous driving tech, while discontinuing some sedans (Cruze, Impala, LaCrosse, XTS) to focus on more profitable crossovers, SUVs, and pickup trucks.

The 2020 Cadillac XT6 is one of the all-new models meant to reinvigorate the Cadillac brand as part of GM’s strategy to boost earnings from the brand

Despite these actions, the value of GM stock has traditionally struggled to surpass the $40 mark, spending most of its time stuck in the $33-$38 per share range. The chain of events is problematic given that the “new GM” had its Initial Public Offering (IPO) at $33 per share in November 2010, frustrating many investors.

We remain interested in seeing how GM stock performs during the final two quarters of 2019, especially as the Detroit-based automaker launches its GEM-based vehicles for developing markets, completes the roll-out of its full-size pickup trucks, and begins to launch its all-new full-size SUVs and various new Cadillac models. All of these products are expected to contribute significantly to GM’s bottom line.

In addition, the automaker was planning to roll out an autonomous ride-sharing service from its Cruise division by the end of 2019, but has announced that it will push back that timeline. GM sees the robo-taxi service as a “trillion-dollar opportunity.”

In July 2019, GM unveiled the new Corvette, which adopts a mid-engine layout for the first time in its history. The mid-engine Corvette, also known as Corvette C8 or the 2020 Corvette, will launch around December 2019. The vehicle is also expected to contribute in a healthy manner to GM’s financial performance, since the Corvette carries healthy profit margins.

Subscribe to GM Authority for ongoing GM stock news and complete GM news coverage.

Comment

I wonder why it went up, they still refuse to take care of their 8spd transmission problems. As GM Factory told me “if it has not broke down on the side of the road, its performing as designed”