A few months ago, GM Authority reported that Goldman Sachs was in discussions to transfer its GM credit card business to Barclays after the former decided to drop the business as it attempts to exit consumer lending entirely. With that in mind, it appears as though the two companies are close to finalizing such a transaction.

According to a report from Reuters, Goldman Sachs’ move to exit the business partnership with General Motors – which includes roughly $2 billion of outstanding balances – comes as it continues to narrow its focus on consumer services. As such, the two companies are moving towards final negotiations.

It’s worth noting that neither Goldman Sachs nor Barclays provided any comments on this pending transfer.

For context, Goldman Sachs is expected to take a notable business hit in the third quarter of the 2024 calendar year. In fact, its CEO noted in a conference last Monday that the sale of loans to small- and medium-sized retail businesses – along with its plans to exit the GM credit card partnership – will likely result in a pretax charge.

“The combination of those things this quarter will likely have an approximately $400 million pretax impact, largely showing up in revenues,” Goldman Sachs CEO David Solomon remarked in a prepared statement.

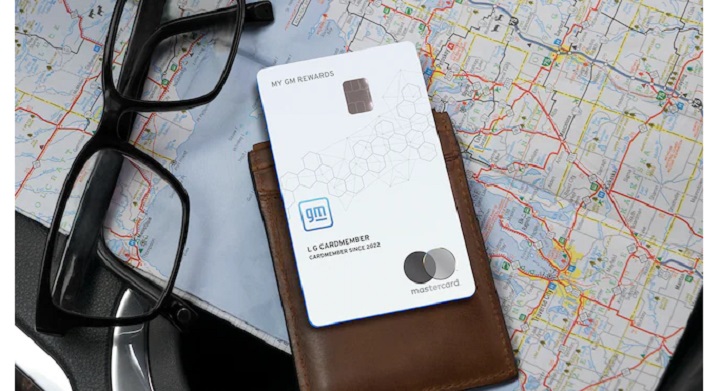

Of course, Goldman Sachs originally had plans to scrap its GM credit card venture as far back as November 2023. The program, which was issued by Mastercard through the Wall Street bank, was launched in 2022 in order to allow consumers to earn points towards buying or leasing Buick, Cadillac, Chevy and GMC products.

In explaining its reasoning behind its November 2023 decision to axe the project, Goldman Sachs stated that GM dealerships demonstrated minimal interest in promoting or using the credit, despite the focus on vehicle buying. Interestingly, approximately 70 percent of credit card users targeted their purchases toward this goal, which comes in spite of the lack of interest from said dealers.

Comments

OF COURSE, the transfer will take place in mid December and then, instead of enjoying the holidays with family and friends, I’ll be spending a full week contacting all of the dozens of vendors that I have on autopay with the card. Because the new card will have a new number. OF COURSE. Not a doubt in my mind.

And then, we’ll be looking at this again in another 3 years when Barclays gets tired of it.

There’s cards out there with far better earnings and benefits, why not just switch to one of those now, and not have to worry about it if you’re already stressing about it?

That doesn’t help. I want the Earnings accrued for a new vehicle in 2026, assuming the market has righted itself by then.

Far better? This card earns 4%, you are hard pressed to find many that earns points at that rate. Yes it limits you to a vehicle, but if you are buying it doesn’t matter, you are lowering the cost of interest you end up paying or the hit to your cash on hand. So by the time I buy I would save over 25k in interest charges with the points I have accrued. It is a great use of credit benefits. Next card though will be an airline card or something that earns travel benefits to fly business class overseas on vacation travel.

It is not limit the card holder to buying a vehicle, I use my points for oil changes on my 2 Chevys, and last year bought $1200 worth of tires with my points. I have had a GM card since the 1990’s and have used it to help when purchasing a new vehicle also. Like I said it is not limited to only buying a vehicle. One word to the wise, make sure you have another card holder on the account, I had a friend that had accumulated 1000’s of dollars in points and was going to use towards a new vehicle, but he died suddenly and his name was the only one on the account, his spouse was screwed out of the points since he was the only one on the account.

Please tell me what card gets you 4% on ALL spending, and for those of us grandfathered into the old GM card 5%? Please don’t tell me it’s one of the high annual fee transferable points cards (Amex Green/Gold/Platinum, Venture X, Chase Sapphire etc.) because getting above 2% on those takes a lot of legwork. To get more than 2% on everything with those cards you have to transfer your points to some third world airline and redeem them for business class seats. So the only way to get more than the 4% on everything like the GM card does, you need to want to fly international business class on a non-US carriers and scour the airlines websites constantly for the low priced rewards.

I like the card, especially the generous point accruals. But wow, some of the worst customer service I’ve ever encountered. Supervisors are usually great, but the tier-one reps are clueless. They often make up answers, which of course wasted my time. Maybe the transition to Barclays will help. Here’s hoping!

My sister’s main credit card is with Barclays and THEY have the worst-rated customer service on the planet.

you are a dumba$$ if you carry a balance on a gm card to save a buck on a new vehicle.

if you need to carry a balance there are better cards out there.

Ok, name some and what rates they get.

This card gets 4%, already one of the highest out there. Let’s say I get 2.9% on a 60k truck. Trade in let’s say 15k. So now I am paying 2.9 for 60 months on 45k. That is $3,400 in interest charges. If I take that 25k I have on my GM card from earning 4% on purchases and apply it to the truck, now I am financing 20k and only paying $1,500 in interest, just saved $1,900 more, on top of the $25k I earned just from using my credit card that I don’t have to pay on a new truck. Far from dumbass, it is smart when you are compounding that amount saved.

No one is carrying a balance, it is paid off each month if you understand how credit cards work and how to take advantage of them….

No one is carrying a balance? Come on, most people do not pay off credit card every month. If you believe what you said, it is time to wake up.

We haven’t carried a balance since I retired 26 years ago. One GM vehicle bought with card dividends prior to retirement, eight since.

GS was the first bank to require PIN’s. Mine went through smooth as silk. My wife’s took three days of angry phone calls.

I believe what he said and I am wide awake. I never carry a balance on any credit card. That is just stupid.

story said 2 billion in balances