General Motors (GM) has maintained its position in the latest Plante Moran 2024 North American Automotive OEM-Supplier Working Relations Index (WRI) Study, reflecting steady relations with its suppliers amidst industry challenges. Plante Moran, a leading accounting and consulting firm, released the findings from its 24th annual WRI Study earlier today, highlighting the relationship dynamics between U.S. automakers and their suppliers. The study examined six major OEMs: GM, Stellantis, Ford, Honda, Nissan, and Toyota.

The study revealed that five out of the six OEMs improved their supplier relationships despite ongoing tensions over cost recovery issues related to materials and tooling. These tensions have been exacerbated by fluctuating demand for electric vehicles (EVs), with some automakers shifting towards hybrids or canceling EV programs while increasing production of internal combustion engine (ICE) vehicles.

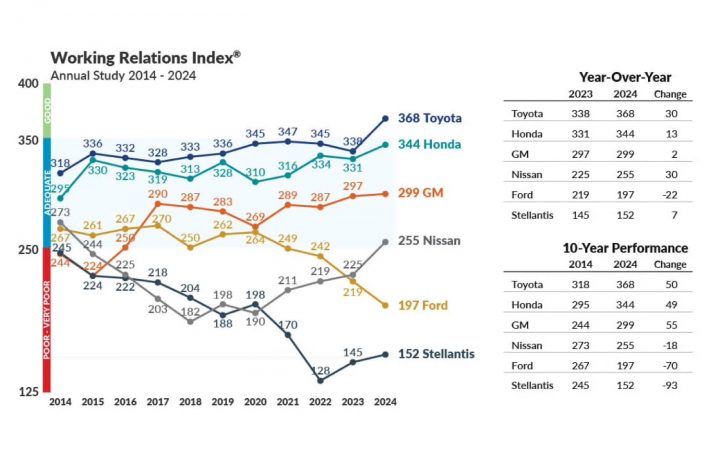

In the 2024 WRI rankings, GM scored 299 points, marking a slight improvement from its previous score of 297. Toyota led the index with a score of 368, followed by Honda at 344, and Nissan at 255. Ford experienced a decline, dropping to 197 points, while Stellantis remained at the bottom with 152 points.

Dave Andrea, a principal at Plante Moran’s automotive and mobility strategy consulting practice, commented on the findings: “With all the challenges and conflicts facing suppliers this past year, it’s not surprising that some automakers dropped even further in their scores. But what might be surprising to some is that several automakers improved their scores significantly during the past year. This shows that piece price economics alone is not what drives the automakers’ WRI score but that the score also reflects the tangible and intangible costs to serve the OEMs.”

Key takeaways from the study emphasize the need to update outdated contract terms and purchasing practices to better manage the EV transition. The study also highlights the necessity for corporate leadership to collaborate in reducing supplier costs and risks. Additionally, it stresses that annual price reduction demands from OEMs must account for the total cost of supplier relationships.

The 2024 WRI Study was conducted between mid-February and mid-April 2024, with responses from 696 executives at 429 Tier-1 suppliers. These responses represented over 50 percent of the annual purchases of the six OEMs in North America. The supplier respondents included 41 of the top 50 North American suppliers and 69 of the top 100, ensuring a comprehensive overview of the industry’s supplier relationships.

Subscribe to GM Authority for more GM business news and around-the-clock GM news coverage.

No Comments yet