Days ago, French automaker PSA Group officially announced plans to purchase General Motors’ European operations, Opel-Vauxhall, for €2.2 billion ($2.33 billion USD). Rumors of the deal had initially spurred heaps of uncertainty among Opel-Vauxhall plant workers, stimulating union and government officials in Germany, the United Kingdom, and Spain to meet with PSA executives regarding the security of those jobs. Looking back, the concerns may have been premature, since PSA Group’s chief executive’s message to Opel and Vauxhall is simple: “we’re here to help”.

Speaking to reporters on the sidelines of the Geneva International Motor Show, PSA CEO Carlos Tavares expressed his sentiments towards the unit his company is acquiring from GM. Turning things around isn’t new for once-troubled PSA, which received a bailout from the French government and a sizable capital infusion from Chinese investors during the financial crisis several years ago.

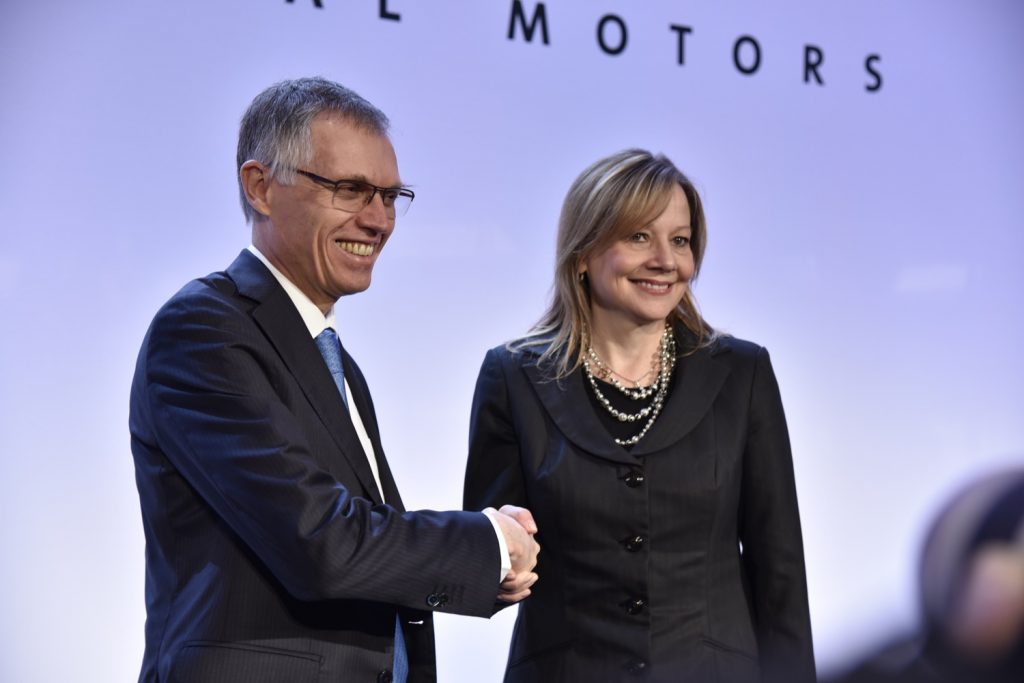

PSA CEO Chief Carlos Tavares (left) shakes hands with GM CEO Mary Barra (right)

“The position we are taking here is: We are here to help. We think we can help because we were in the same position four years ago”, said Tavares. “We were also in a difficult financial position, and we were able to turn around our company.”

Bringing Opel-Vauxhall into the black will be no simple task, as the unit “has been making red ink for 10 years, and burning 1 billion euros of cash every year. I think we need all to realize that there is a problem”, said Tavares.

But overall, it’s not an insurmountable task, especially with the scale economies that can be achieved between PSA, which markets the Citroen, Peugeot, DS Automobiles brands, and Opel-Vauxhall.

“We believe that, with humility but some confidence, we can help Opel and Vauxhall turn around”, Tavares stated, while adding that any jobs cuts in the future would not be part of any planning, but rather from overall changes in the industry. Industry analysts don’t see it that way, with some prognosticating jobs cuts totaling 5,000 positions in the combined automaker within the next decade.

Comments

So why is a damaged brand like PSA allowed to reinvent itself and then be excepted by the people of Europe but when GM tries it the people of Europe say No?

This notion of a car company being damaged is a joke, the idea that once a company falls on hard times people around the world will never buy their products again is absurd.

This process has happened time and time again over the last 50 years, but the one company that people around the world will not let off the hook is GM! Every manufacturer has let their customers down at different times and customers return at some point forgiving the company. People seem to hold GM to a higher standard then the rest of the world, kind of like how GM gets ripped for sharing engines and platforms when other manufacturers do it and people don’t bat a eye at it!

PSA is not a brand, but a company.

This company markets its products under three different brands:

– Citroën

– DS

– Peugeot

I am sorry I lumped them all into 1 but I am sure you get the point I was trying to make

Brian – I understand fully what you are getting at but the problem with GM in Europe has been consistency. Opel’s troubles started with the Lopez era of cutting costs that dented quality & reliability. Then you have the SAAB debacle that damaged GMs reputation. The millions of re-launches of Cadillac. The Daewoo becomes a Chevrolet episode and then the Chevrolet is gone completely finale. To cap it all off just as Vauxhall-Opel is getting close to break even they sell it or to be more precise pay PSA to take it. $260m loss last year for GM Europe – GM spends more than that on a model mid cycle facelift. Chevrolet never returning to Europe is not a GM problem as such it is a Chevrolet problem – the name is now a liability not an asset, and I don’t think GM or anybody else can change that.

“the name is now a liability not an asset, and I don’t think GM or anybody else can change that.”

If your words represent the sentiment of the European car buyers at large (and that’s a big *if*), then that can be fixed with a decade or two of good product, consistent marketing and solid sales/after-sales experiences. Luckily, GM has figured out how to lead on all three in North America… and doing the same in the European market is not rocket science.

Unfortunately Alex GM hasn’t learnt any of the 3 – which is why GMs market share of a growing market in the US up to now has been stagnant. On current performance GM has an absolute zero chance of ever becoming anything other than very small side show in Europe.

“The Penalty of Leadership” was an old Cadillac ad that touted the higher expectations of a leader. Unfortunately GM is no longer a leader but may be held to unreasonable standards.

Look at the VW group and dieselgate. They should be reeling. Yet they are constantly releasing new models or getting favorable press coverage for their products. Their customers are not getting mad either. They are in touch with their market.

GM is producing great cars and trucks right now. But I would suggest that they are not as close to their customers as the competition and the same applies to the media. Sure GM knows the truck market but do they really understand the car consumer, particularly in foreign markets?

Opel has progressively moved downmarket partly because areas where it was once strong have contracted or because it has not been able to elevate the status of its brand. As an example it had great penetration in the wagon market but that has shifted. The Zafira was innovative but somehow Opel lost the ball in this sector as others caught up.

Ultimately it is all about products that have been developed to meet the needs of the consumer, a consumer that you understand intimately. The media will sense if you are proud of your product and close to your customers and they will help the process along.

I always wondered why GM did not put out the Buick Envision as Opel too.

Instead Opel was instructed to develop an alternative together with PSA.

The result had been proclaimed last Monday.

Yup, that is a very good point. The reason that Opel didn’t get the Envision is named Steve Girsky, who — under Dan Akerson’s protection — lobbied hard to get the PSA alliance in 2012/2013. The strategy didn’t make sense then, and it still doesn’t make sense now.

There was no reason that Opel couldn’t get the Envision and release a new version of the Meriva (on GM’s corporate G2 architecture), thereby negating the need for products like the Grandland X and Crossland X.

When I first heard of this GM-PSA deal, I thought the two would form a real alliance similar to the Renault-Nissan alliance. That would have made sense, in my view.

I have no facts to base this assumption off but here goes.

GM likely has provided Opel’s European bankers with guarantees that far exceed the $10 billion plus pension obligations. As such a last ditch liquidation of Opel would have been worse than what GM had to provide PSA, because GM would still have had to pony up to the bankers.

One likely reason this deal will take into the third quarter to finalize is that the bankers need to agree to PSA taking over any bank guarantees currently extended by GM.

As such an alliance was off the table because GM would not have had anybody to unburden the bank guarantees onto.

Please note this is just my assumption, but is the only way I can rationalize GM’s actions.

Well GM has been struggling to change the image. But the are doing well in profits and cost so they have time to continue the change. Changes like this do not come over night for anyone.

As for FCA and PSA they both are also at the start of the curve and have an even more rocky road to recovery.

FCA is far from major profits and cost control. They have the most slots in the top ten worst cars and major recalls.

PSA is trying to do a VW but to grow globally their brands are far from admired ad desired in most areas.

They have a major hill to climb and Opel is not going to make their move a sure thing.

Let’s face it how many of you or your friend have said I wish I could buy a Peugeot or Citroen.

Let’s face it how many of you or your friend have said “I wish I could buy a Peugeot or Citroen?”

With sales of circa 1.5m last year it would seem quite a few!

That’s true, but sales volume is just one metric that doesn’t really matter any more.

To wit: if Opel-Vauxhall sold just 1,000 cars in all of 2016 and turned a profit of $100 (yup, one hundred USD), it would be better than its performance over the last decade+.

Me. I owned Peugeot 205 for a quarter of a century, 3 in a row (the first two were victims of careless drivers bumping into my car’s rear). And I liked it. The 205 was a beautifully designed car, and it was economical and good to drive.

As a child, I had to ride hundreds of kilometers in the back of a VW beetle, and I cherished French cars because the all had four doors, even the tiny Renault 4CV (look that up in Wikipedia).

And I think that Opel tried to counter the success of the VW Beetle with the small car “Kadett” as sedan was a bad idea. The Renault 4 with the large hatch back already showed the way to go. And after some stumbling, VW finally “got the curve” as the German saying goes, and followed suit with the Golf as hatchback. Opel had to follow, but was not the pioneer.

As to the “circa 1.5m” — PSA sold 3.15 million.

I was only referring to Europe which is 1.93m so circa 1.5m wasn’t far out! lol

Well it’s good to hear the different opinions but the best deal went to PSA. Opel will make money now that the $11Billion GM pension feasco is off their back. I have said this was a GM management screw up and they are still holding the bag for $6 billion pension bill. Some deal. Time will tell how good the deal was. You can put it with the rest of the deals like Detroit Diesel, heavy trucks to Volvo, Electro-Motive to Catapillar, GM Defense, Allison, Terex, American Axle, Delco and on and on. If you can’t manage it sell it. Could it be Chevrolet and Cadillac having problems in Europe because of the French names? Hmmmmm

Unfortunately Alex it is a metric that is vital and is the basis for why PSA wanted to do the deal they have. GM are swimming against the tide of what everybody else in the auto manufacturing industry is trying to do and they will be the ultimate losers. GM has put all its eggs in one basket – China. It will only take an incident with the idiot in North Korea to set off a chain of events that would see a backlash in China against anything remotely American and then GM are screwed.

Sure, sales volume is an important metric. Yes, it contributes to scale economies and all other forms of operational components of an organization. I am not disputing that.

Rather, my point is that, if at the end of the day (year), you sell millions, billions, gazillions of cars only to post a loss, then sales volume is good for absolutely nothing. As in you just spend all that time and energy and capital, but paid to play.

That said, GM is not putting its eggs into China since it makes very little in profits there:

http://gmauthority.com/blog/2017/02/general-motors-2016-full-year-net-income-revenue-earnings/

Rather, GM makes 97-98 percent of its operating profit in North America, and 95% of GMNA profit is made in the U.S. Essentially, GM is currently a company reliant on the United States market.

Now, there are significant efforts within the company (headed by Dan Ammann’s team) to diversify and de-leverage. This served as the primary reason for the Opel-Vauxhall sale, since it ends the cash flow leak. From there, the sane strategy would be to become less reliant on GMNA by expanding into other global markets. The question is, where to go?

– China is already being milked for all it’s worth, and though the sales volumes are impressive, the already-tiny profit margins need to be shared with the mandatory/forced “partner” SAIC

– South America can’t be milked until Brazil, Colombia, and Venezuela stabilize economically

– Africa is a non-starter

– Australia/NZ has some opportunity to optimize sales volume off, which is underway

What’s left are Russia/CIS and Europe. So, the sane strategy is to focus on the profitable expansion of the remaining GM brands — namely Cadillac and Chevrolet — in those markets.

What you say is quite logical but it just serves to prove the point that GM has made a huge mistake. If the only way to expand is with Chevrolet & Cadillac in Europe & Russia then GM is well and truly dead in the water. As I posted elsewhere GM is on course to end up being a primarily US based auto maker and will eventually, maybe within 10 years, be taken over by somebody else. Here and now the future is very bleak indeed. As for Australia and NZ there is no way forward yet again GM burnt it’s bridges and is now paying the inevitable price.