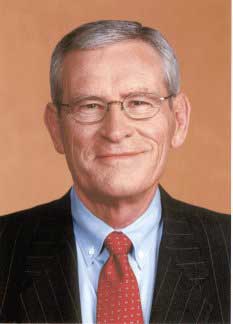

Why is GM's Ed Whitacre smiling?

Welly well well… not too long after the government hired a New York firm to prepare General Motors’ post-bankruptcy IPO, the U.S. Securities and Exchange Commission disclosed that the company’s highest ranking officers and executives received over 100,000 total shares of stock estimated to be somewhere in the ballpark of $13 million. Those who have been disclosed that received shares include:

- Chairman/CEO Ed Whitacre: 24,547 shares

- GM North America President Mark Reuss: 25,104 shares

- Vice Chairman Tom Stephens: 50,521 shares

- Vice Chairman/CFO Chris Liddell: 15,979 shares

- Vice Chairman Steve Grisky: 18,063 shares

While it’s been a widely-publicized goal of General Motors to go public as soon as possible, Ed Whitacre has cautioned that an IPO will not happen until he believes its maximum value can be attained. According to some analysts, this could take as long as another year or two. Considering Whitacre now has 24,547 reasons for a successful IPO, it’s easy to understand why.

The GM Authority Take

I understand the logic behind providing GM’s senior management team with this amount of yet-unsold stock. Instead of being awarded bonuses or salary raises, stock is used to compensate for salary cuts and certain lack of benefits. It also provides a huge incentive to make the overall organization a success. But GM’s senior management team isn’t the only one within GM to have taken a cut – there are thousands of other GM employees that were forced to see salary and benefit cuts as well. In all fairness, all of those hard working men and women should also receive the spoils of free shares of the company they have worked so hard to bring out of its darkest period in history. Wouldn’t you agree?

[Source: The Detroit Bureau]

No Comments yet