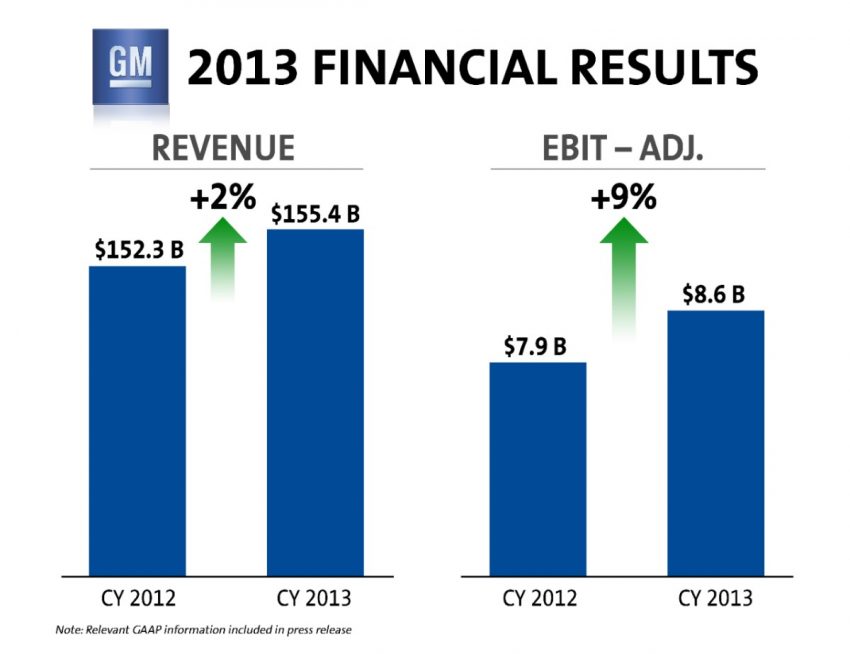

General Motors has reported an increase in revenue and adjusted EBIT (Earnings Before Interest and Taxes) but a decline in net income and earnings per share (EPS) for the full year 2013. The results follow GM’s Q4 2013 earnings of higher revenues and flat net income.

On an annual basis, full-year 2013 revenue increased 2 percent to $155.4 billion, net income dropped 29 percent to $3.8 billion, EPS was down 22.69 percent to $2.38, and EBIT-adjusted was up 8 percent to $8.6 billion. To note, full-year 2013 EBIT-adjusted includes the impact of restructuring charges of $(0.4) billion.

GM states that several special items during the calendar year impacted full-year net income to common stockholders unfavorably. These totalled $(1.3) billion, or $(0.80) per share, compared to an unfavorable $(0.5) billion impact in 2012, or $(0.32) per share. These special items included “charges for several strategic decisions taken to improve the company’s future competitiveness in key global markets.” Additionally, full-year results were also impacted by incremental tax expense of $(1.7) billion or $(1.02) per fully diluted share compared to 2012.

“Launches of some of the best vehicles in our history combined with significant improvements in our core business led to a solid year,” said GM CEO Mary Barra. “The tough decisions made during the year will further strengthen our operations. We’re now in execution mode and our sole focus will be on delivering results on a global basis.”

| METRIC | FULL YEAR 2013 | FULL YEAR 2012 | DELTA 2013 VS. 2012 | PERCENT CHANGE |

|---|---|---|---|---|

| REVENUE | $155.40 | $152.30 | $3.10 | +2.04% |

| NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $3.80 | $4.90 | ($1.10) | -22.45% |

| EARNINGS PER SHARE (EPS FULLY DILUTED) | $2.38 | $2.92 | ($0.54) | -18.49% |

| IMPACT OF SPECIAL ITEMS ON EPS FULLY DILUTED | ($0.80) | ($0.32) | ($0.48) | +150.00% |

| EBIT-ADJUSTED | $8.60 | $7.90 | $0.70 | +8.86% |

| AUTOMOTIVE NET CASH FLOW FROM OPERATING ACTIVITIES | $11.00 | $9.60 | $1.40 | +14.58% |

| ADJUSTED AUTOMOTIVE FREE CASH FLOW | $3.70 | $4.30 | ($0.60) | -13.95% |

Geographic Segment Results

- GM North America (GMNA) reported full-year 2013 EBIT-adjusted of $7.5 billion compared to $6.5 billion in 2012, setting a record for earnings in the region. Based on GMNA’s 2013 financial performance, GM will pay profit sharing of up to $7,500 to approximately 48,500 eligible GM U.S. hourly employees.

- GM Europe (GME) reported full-year 2013 EBIT-adjusted of $(0.8) billion compared to $(1.9) billion in 2012.

- GM International Operations (GMIO) reported full-year 2013 EBIT-adjusted of $1.2 billion compared to $2.5 billion in 2012.

- GM South America (GMSA) reported full-year 2013 EBIT-adjusted of $0.3 billion compared to EBIT-adjusted of $0.5 billion in 2012.

- GM Financial reported full-year 2013 earnings before taxes (EBT) of $0.9 billion, compared to $0.7 billion in 2012.

Cash Flow And Liquidity

Full-year 2013 EBIT-adjusted was $3.7 billion compared to $4.3 billion in 2012.

GM ended 2013 with strong total automotive liquidity of $38.3 billion compared with $37.2 billion at year-end in 2012. Automotive cash and marketable securities was $27.9 billion at the end of 2013, compared with $26.1 billion a year earlier.

GM expects capital expenditures for 2014 to be approximately $7.5 billion.

Pension Update

GM’s year-end global pension obligations stood at $99 billion and were approximately 80 percent funded at the end of 2013. The year-end unfunded position was $19.9 billion, down from $27.8 billion at the end of 2012.

GM’s U.S. defined benefit pension plan obligations of $71.5 billion ended the year approximately 90 percent funded. The year-end underfunded position was $7.3 billion, down by almost half from $14 billion the year prior. For 2013, the return on U.S. defined benefit pension plan assets was approximately 3 percent.

Under current economic conditions, GM expects no mandatory contributions to U.S. defined benefit pension plans for at least five years. GM stated that though it will continue to evaluate opportunities to make voluntary cash contributions, it has no current plans to do so in 2014.

“In 2013, we strengthened our fortress balance sheet and delivered consistent earnings, providing the foundation for a quarterly dividend for our shareholders this year,” said Chuck Stevens, GM executive vice president and chief financial officer. “This year we’ll leverage our strength in the U.S. and China to execute important restructuring activities in other key global operations.”

Comments

Well this doesn’t sound so bad. I was reading that other site this morning and you’d swear the sky was falling by the reaction to profit being down. To roll out as many new models as the general did in North America alone and grow the revenue is impressive.

This is a case where you have to do your home work and understand the back ground on why things show as they are.

Several Wall Street people have stated that GM right now is like a low mileage used car with some cosmetic damage. On the surface it has a few issues but under the skin it is getting stronger.

It will be a short while longer for GM to pay off their sins of the past and get thing where they would like them but this is only one more step on the path of progress.

They are not looking at profitability Quarter by Quarter as they are building a path to make it profitable year after year. This is a long term plan.

Right now GM compared to Chrysler is 5 years ahead on their plans and product. Also GM does not have a financially strapped Fiat pulling the strings.

GM should be fine.