A new report reveals that car insurance rates in the U.S. are expected to surge by an average of 22 percent by the end of the year. The anticipated hike follows a significant 15-percent increase recorded during the first half of the year, and follows on the heels of a 24-percent rise in full-coverage premiums during 2023. The driving forces behind these escalating costs include higher vehicle prices, more expensive repairs, and a slew of other contributing factors.

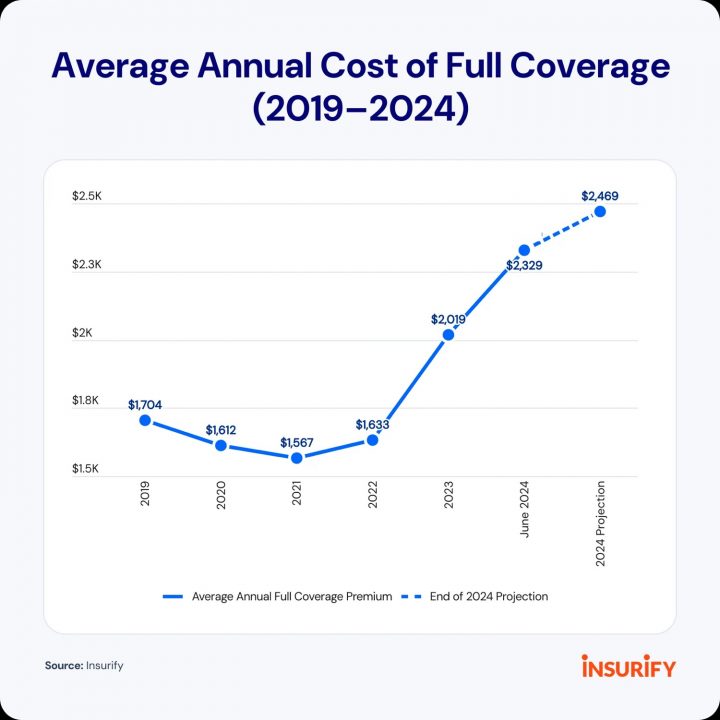

The findings come from a report published by Insurify, a U.S.-based insurance comparison platform. According to the report, the average cost of full-coverage car insurance has already climbed to $2,329 annually as of June 2024 and is expected to reach $2,469 by the end of the year.

The report points to several factors contributing to rising insurance premiums. One of the primary drivers is the increased cost of vehicles and repairs. As vehicles become more advanced, particularly with the integration of sophisticated technologies like advanced driver-assistance systems (ADAS), repair costs have skyrocketed. The report highlights a nearly 38-percent surge in vehicle maintenance and repair costs since 2019. Electric vehicles (EVs) are also contributing to these higher costs, as the report indicates that, on average, EVs require more time and expense to repair than traditional gasoline-powered cars.

In addition to these factors, severe weather events have also played a significant role in elevating insurance premiums. States like Minnesota, Missouri, Florida, and California have been particularly hard hit by hailstorms, hurricanes, and wildfires, prompting insurers to raise rates to cover the increased risk. In California, the situation is exacerbated by a pandemic-era freeze on rate hikes that has only recently been lifted, leading insurers to seek substantial rate increases. Some insurance companies are even exiting high-risk states like Florida and California altogether, further straining the market.

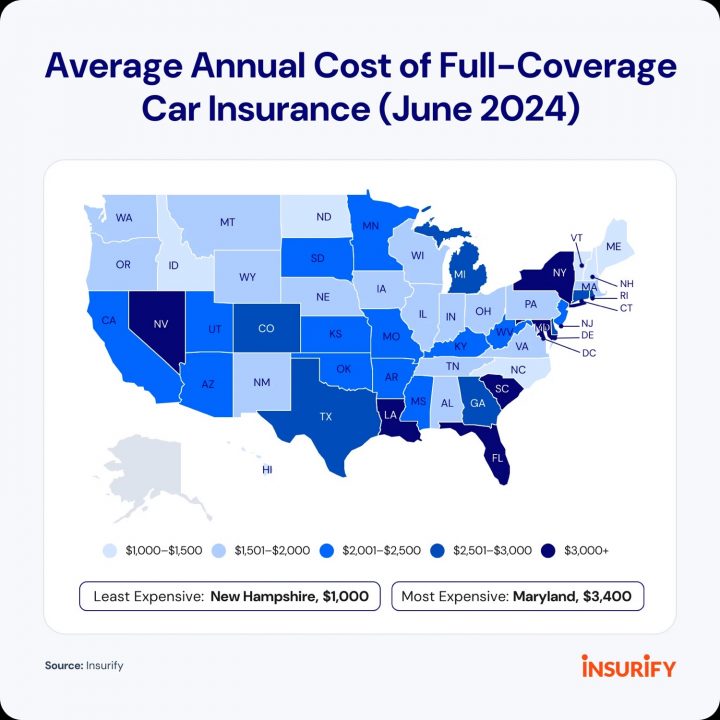

Legislative changes in states like Maryland and South Carolina have also added pressure on insurers, leading to higher premiums. Maryland currently tops the list with the highest average car insurance costs at $3,400 annually, followed closely by South Carolina at $3,336 and New York at $3,325.

The report suggests that while some regions might see a bit of relief as insurers adjust their strategies, most drivers should brace for continued increases due to inflation and the relentless impact of severe weather, among other factors. However, there are ways to mitigate these rising costs – for example, drivers can shop around for better rates, consider raising their deductibles, or enroll in telematics programs that reward safe driving behaviors with potential discounts.

Subscribe to GM Authority for more GM business news and around-the-clock GM news coverage.

Comments

Guess I’ll hang onto my old Silverado a while longer

“Electric vehicles (EVs) are also contributing to these higher costs, as the report indicates that, on average, EVs require more time and expense to repair than traditional gasoline-powered cars.” Welp! There goes your savings in gas and maintenance costs. And if you live in an apartment complex, get ready to pay more for less with an EV. What a bright future we have going for us. So bright it shines from our wallets burning.

AND, several states will be increasing annual registration costs from EV’S to $1,000 or more. Why? Because they’re losing gas tax money from these bricks.

On the higher rates:

I think that we’ll see more car companies provide their own insurance with cheaper rates, if that’s the case. -Cheaper rates always win out.

I had the same insurance company for 40 years. Rates doubled in past year. Shopped around found quote for less than half of what I was paying.

who did you go with, don’t be afraid to say.

If EV vehicles are contributing to higher costs then EV OWNERS should bear this cost NOT owners of ICE powered vehicles .

People are responsible for the damage they cause to other vehicles, regardless of whether they are a Corolla or a Rolls Royce.

If a toyota front fender cost $1000 to replace and a rivian fender costs $10,000 well do the insurance math. Why should my toyota insurance have to cover the EV extreme costs

Went with State Farm.

How ironic? After having State Farm for both my home and auto insurance for over 30 years my agent passed away. His replacement doubled my car insurance and raised my home insurance by 50%. I shopped around and found an Allstate agent in Kentucky ( I’m in Ohio) that matched my original rates and is keeping them the same going into year two.

I live in one of the cheap states, but my insurance for a Blazer EV would have been very expensive.