While automotive buyers are increasingly struggling with monetary difficulties according to research findings, GM Financial remains a bright spot for them, with customer satisfaction in the service above average in the J.D. Power 2024 U.S. Consumer Financing Satisfaction Study.

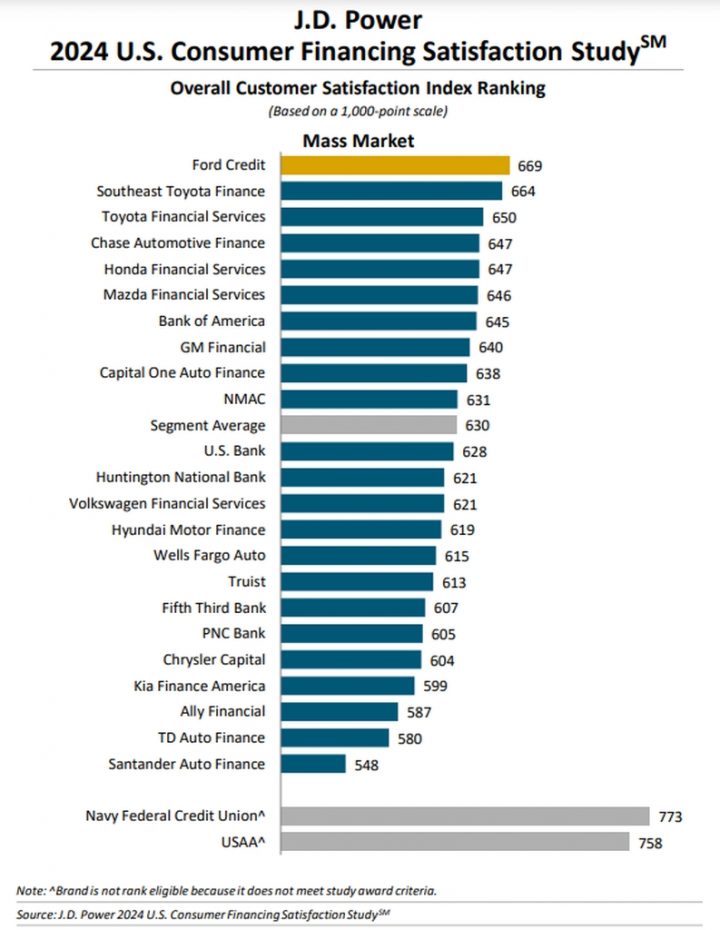

GM Financial got a rating of 640 points out of a possible total of 1,000 in the mass-market financing segment, significantly above the segment average of 630 points.

Though somewhat eclipsed by the 669 points of first-place mass-market service Ford Credit, GM Financial outperformed above-average financiers Capital One Auto Finance and NMAC. Satisfaction ratings from last year are not directly comparable since J.D. Power used different values to determine ratings for 2024.

The satisfactory performance of GM Financial is more notable given the struggles auto buyers are currently undergoing with financing. Prices and car loan interest rates are still close to historic highs, while consumers are losing economic ground. About 13 percent less auto buyers are rated as “financially healthy” than in 2021, while the number of “financially vulnerable” buyers is up 11 percent.

J.D. Power ran its study surveys from late 2023 through August 2024, gathering responses from 11,071 car buyers or leasers. These respondents provided their feedback on eight different aspects of financing satisfaction for their new-vehicle purchase or lease for the various available financing sources, including GM Financial.

Senior research director Patrick Roosenberg said that the situation and responses highlight the fact that “auto lenders really need to tailor their offerings for the realities of the current market.” He added that the lenders should “recognize that a large portion of their customers may face some very real challenges managing their finances” – which GM Financial apparently does, given its above-average customer satisfaction rating.

Roosenberg also provided some suggestions for auto lenders going forward, remarking that they “need to ensure that their digital bill-pay tools encompass a wide range of options, such as extensions, due date changes, personalized financial planning/budgeting tools and one-on-one advice” for users.

No Comments yet